Meet UOB TMRW Vietnam, the digital banking app that helps you take charge of today.

UOB TMRW Vietnam – A new banking app for seamless everyday banking on-the-go. Make instant and secure payments and transfers anytime, anywhere, access eStatement, view and redeem rewards, track your spending and saving patterns with Smart Insights, curated just for you.

Experience UOB TMRW Vietnam now and embark on a journey to smarter and effortless banking.

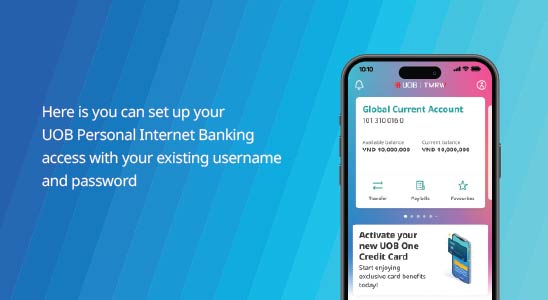

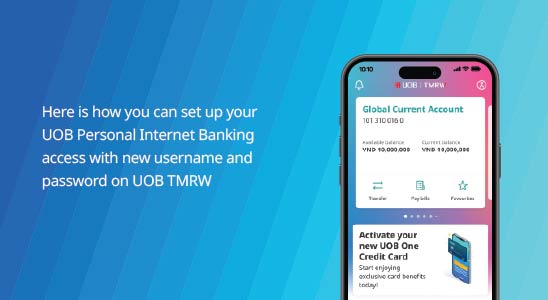

For Migration Customers

Get ready for the new digital banking experience with UOB TMRW Vietnam.

FAQs

I want to reset my username/password

You cannot reset your username. If you would like to reset your password, follow these steps:

If you have Face Recognition, follow these steps:

- Log in to UOB TMRW Vietnam

- Tap on "Forgot?"

- Choose ID document type & input info registered with bank

- Input SMS OTP

- Verify yourself via ID card

- In the next screen, your username will be displayed. Proceed to change your password in this screen.

- Set your new password and click “Submit” to confirm

- You can now login with your new password.

If you don't have Face Recognition, follow these steps:

- Foreign customers: please go to the branch to continue updating

- Vietnamese customers: please prepare your ID Card and follow these steps on screen

Can I set a limit for my purchases?

Yes, you can! To set a limit, navigate to your respective card and tap "Services" followed by "Spending limits" for Store and Online Purchase. Enter your desired limit and tap "Confirm". Complete the transaction by authenticating it with your Secure PIN.

How do I make my bill payments?

Log in to UOB TMRW Vietnam and tap "Pay Bills" on your main page. Select the biller you intend to pay and enter the details. Check the "Add to Favourites" option if you want the details to be saved for your future transfers and swipe to confirm.

I lost my card. How do I lock it and get a replacement?

For security reasons, we advise you to temporarily lock your card following the steps below first:

- Log in to UOB TMRW Vietnam

- Tap on "Accounts", select "Report lost card" and follow the steps of the app

- Tap on "Confirm" with the "Report lost card" information

- The lost card has been permanently deactivated. If a replacement card is requested by clicking "Replace card"

- Check and click "Confirm" to proceed

- The card replacement request is successful, and the card will be sent within 7 working days

I forgot my Secure PIN. How do I reset it?

Here is how you can reset your Secure PIN.

Entry point from Profile setting:

- Open UOB TMRW Vietnam and tap on “Profile” after login

- Tap on “Password and security”

- Tap on “Change Secure PIN” and select “Forgot Secure PIN” and “Set up now”

- Scan your face to verify

- Tap on "Create Secure PIN"

- Enter your new Secure PIN when prompted

- You can now login with your new Secure PIN

Entry point from Login screen:

- Open UOB TMRW Vietnam and tap on "Forgot" on the Secure PIN Sign In screen.

- Tap on "Reset Secure PIN".

- Log in with your password.

- Tap on "Create Secure PIN"

- Enter your new Secure PIN when prompted.

- You can now login with your new Secure PIN.

When do I need to use biometric authentication for transactions?

Pursuant to Circular 50/2024/TT-NHNN by the State Bank of Vietnam with effect from 01 January 2025, when performing applicable transactions on UOB TMRW Vietnam, Advanced Soft OTP combined with Biometric authentication via facial recognition will be applied, specifically:

- Fund Transfers: Transactions exceeding VND 10 million or a daily total surpassing VND 20 million.

- Bill Payments: Payments over VND 100 million per transaction or a daily total exceeding VND 100 million.

Besides that, Biometric authentication will be required for certain Account Activities such as Actions such as setting up scheduled/recurring transactions, first-time login, or updating personal information.

For more FAQs on UOB TMRW, please visit here.