Which Profile Do You Belong?

The regular savers

- You prefer to make regular savings for your loved ones and family.

- The savings you’ve accumulated over time will go towards reducing your home finance tenor & interest payments.

The investors

- You appreciate the flexibility to take control of your cash flow.

- Tapping into market opportunities as and when they arise.

- The savings you’ve deposited with UOB will go towards reducing your home finance tenor & interest payments.

How It Works

How UOB HomeStar can work for you?

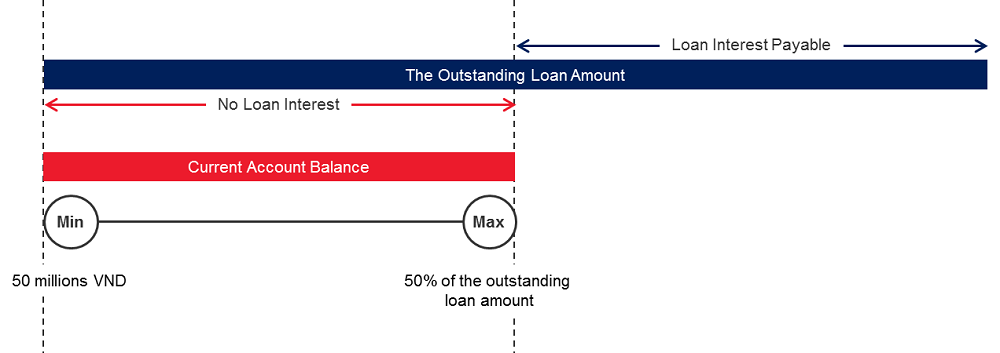

The loan interest amount is calculated based on the net amount of deposit and loan.

Features

At a glance

(*) Term and Conditions apply.

Interest rate quote on 365 days per annual basis and are subject to change from time to time.

HomeStar Calculator

With UOB HomeStar, you can easily find out how much interest you can save.

Mortgage Financed Projects

Click here for more information

This list is updated until August 2025.

| No. | Developer | Project | Project Location | ||

| Ho Chi Minh City | |||||

| 1 | PHU MY HUNG DEVELOPMENT CORPORATION | Panorama | Ton Dat Tien Street, Tan Hung Ward, HCMC. | ||

| 2 | PHU MY HUNG DEVELOPMENT CORPORATION | Happy Residence (S10-2) | Lot S10-2, A Area - Phu My Hung, Tan My Ward, HCMC. | ||

| 3 | PHU MY HUNG DEVELOPMENT CORPORATION | River Park Premier (H24) | Lot H24, Nguyen Duc Canh Street, Tan Hung Ward, HCMC. | ||

| 4 | PHU MY HUNG DEVELOPMENT CORPORATION | Riverside Residence | Lot P5, Nguyen Luong Bang Street, Tan My Ward, HCMC | ||

| 5 | PHU MY HUNG DEVELOPMENT CORPORATION | Scenic Valley 2 (MD4-4) | Nguyen Van Linh Street, Tan My Ward, HCMC | ||

| 6 | PHU MY HUNG DEVELOPMENT CORPORATION | Urban Hill (H6-3) | Lot H6-3 Nguyen Van Linh Street, Tan Hung Ward, HCMC | ||

| 7 | PHU MY HUNG DEVELOPMENT CORPORATION | Happy Residence Premier (S18-2-1) | 18-2-1 Lot, A Area, Nguyen Luong Bang Street,Tan My Ward, HCMC | ||

| 8 | PHU HUNG THAI DEVELOPMENT JOINT STOCK COMPANY (PHU MY HUNG) | Midtown Project: The Grande - M5 The Symphony - M6 The Signature - M7 The PEAK - M8 |

16th Street, Tan My Ward, HCMC | ||

| 9 | PHU MY HUNG DEVELOPMENT CORPORATION | The Ascentia (S4-3) | Lot S4-3, Nguyen Luong Bang Street, Tan My Ward, HCMC. | ||

| 10 | PHU MY HUNG DEVELOPMENT CORPORATION | Cardinal Court (C13B) | Lot C13B, Raymondienne, Tan My Ward, Dist 7, HCMC. | ||

| 11 | PHU MY HUNG DEVELOPMENT CORPORATION | The Antonia (S6-1) | Lot S6-1, Nguyen Luong Bang Street, Tan My Ward, HCMC. | ||

| 12 | PHU MY HUNG DEVELOPMENT CORPORATION | The Horizon (CR8-3) | Lot CR8-3, Tran Van Tra Street, Tan My Ward, HCMC. | ||

| 13 | NDC AN KHANG JOINT STOCK COMPANY (HONG KONG LAND) | THE MARQ | 29B Nguyen Dinh Chieu Street, Sai Gon Ward, HCMC. | ||

| 14 | RIVERFRONT TML (VIETNAM) COMPANY LIMITED (Mapletree) | One Verandah | Bat Nan Street, Cat Lai Ward, Thu Duc City, HCMC. | ||

| 15 | ESTELLA JOINT VENTURE COMPANY LIMITED (Keppel Land) | Estella Heights | 88 Song Hanh Street, Binh Trung Ward, Thu Duc City, HCMC. | ||

| 16 | NAM LONG | Akari City | An Lac Ward, HCMC. | ||

| 17 | NNH MIZUKI (Nam Long) | Mizuki Park | Binh Hung Commune, HCMC. | ||

| 18 | PHU LOC REAL ESTATE INVESTMENT JOINT STOCK COMPANY (Keppel Land) | Celesta Rise | Nguyen Huu Tho Street, Nha Be Commune, HCMC. | ||

| 19 | GAMUDALAND HCMC | Celadon City | N1 Street, Tan Son Nhi Ward, HCMC. | ||

| 20 | RIVIERA POINT LIMITED LIABILITY COMPANY (Keppel Land) | The Infiniti | Tan My Ward, HCMC. | ||

This list is only for reference and subject to change from time to time. For detailed information, please contact our staffs or visit our branches.

Terms and Conditions apply.

FAQs

1. What types of housing loans are currently available?

Currently, UOB Vietnam ("UOBV" or the "Bank") is providing two main types of housing loans, they are:

1. Home Loan: The collateral is the house/apartment, which customer is going to purchase.

2. Loan Against Property (LAP): The collateral is real estate which is under customer's title and/or ownership of customer's relatives and the Loan is used for the purposes stipulated by UOBV and in accordance with the provisions of the applicable regulations.

2. What is the maximum loan amount I can borrow?

Loan amount will be reviewed based on various factors, such as income, loan tenure, all financial obligations with other credit institutions, credit history of Customers and value of the mortgaged property.

3. What is the maximum loan term that can be applied to me?

Up to 30 years for a Home loan and up to 25 years for a LAP. However, the maximum loan term for each case will depend on the age of the customer (the maximum age at the end of the loan contract is 65 years old depending on the type of customer).

4. Can I get advice on the applicable interest rates?

Please leave information here and we will reach out to you for specific advice.

5. During the application process until disbursement, what fees may I have to pay?

The fees and charges that Customers need to pay for related parties include:

1. Real estate Valuation Service Fee: would depend on the type, surface area, location of the collateral, etc. min around VND 2 Million (VAT not included and the fees may vary subjected to the independent real estate valuation Company).

2. Service Fee related to collateral registration/asset guarantee transaction registration/notarisation (stipulated by the State's regulations and/or the service company).

3. Other fees (if any).

6. What documents are required for the loan application I have to prepare?

Basically, customer need to provide:

• Legal documents;

• Income documents;

• Collateral and loan purpose documents.

• Other documents requested (if any) would depend on specific loan application.

Please leave information here and we will reach out to you for specific advice.

7. What is the Bank 's process since Customer submits the application until the Loan is disbursed?

After Customer provides all documents required by the Bank, your application will go through basic steps including collateral valuation, credit appraisal, loan confirmation, notarization, registration of secured transactions and disbursement. During the processing of documents, the Bank staff will always accompany you and be ready to assist you in case of any problems.

8. After I pay off the loan, how long I can get back the original title deed of collateral from the Bank?

Within 3 working days from the date mortgage loan was paid off successfully, Title Deed and relevant documents would be ready to be released to Collateral owner.

9. How does the bank valuate my collateral? Can I choose a valuation company?

The value of your collateral will be assessed by a Valuation Company appointed by the Bank. To ensure independence and objectivity, the valuation company is randomly selected by the Bank and you cannot interfere in this selection process.

10. If I already had current account at the Bank, will the monthly installments be automatically deducted from this account or do I have to make pay..

Customer's monthly installment will be automatically deducted from the Current Account, which Customer has authorised UOBV to automatically collect the monthly debts at the time of loan disbursement.

In other cases, please refer to the instructions here or in the monthly debt reminder SMS (Amount to be paid, Account number to be transferred in) to make payment for monthly installment.

11. Can I prepay the Loan? How is this prepayment made?

Customers can prepay a part or full of the Loan in accordance with the terms and conditions related to prepayment, which is stipulated in the Credit Agreement. Please contact us to get support for prepayment request.

12. How will my credit history be affected when the Loan is past due?

Depending on the number of overdue days, UOBV will classify your loan into different credit debt groups and report to the National Credit Information Center of Vietnam (CIC). This may impact to your credit prestige and cause the potential rejected/ low approval rate from UOBV or other banks.

13. What do I need to do to ensure repay the loan on time?

Please refer to Facility Agreement. Besides, every month UOBV will send SMS to Customer's registered mobile phone number to remind about the debt repayment obligation, with the content including due date, amount to be paid, account number to transfer money in. Customers please prepare financial resources and make loan payments according to the information of this message.

Additionally, Customers can easily access to loans information right on UOB TMRW Vietnam.

14. What do I need to do to get help with loan inquiries?

For Customers already had housing loan account at UOBV, you can easily access to housing loan information right on UOB Mighty. Please refer to the guidline here.

For Customers interested in UOB housing loan, please fill in this form and we will call to assist you soon.

In addition, you can contact us for further assistance.