Universal life insurance product - PRU-WHOLELIFE COVER

Features

Death/ Total & Permanent Disabilities Benefit

From 100% sum assured

Accidental Death Benefit

From 200% sum assured

Loyalty Bonuses Benefit

From 50% - 150% of one annualized target premium

Terminal Illness Benefit

Zero - interest cash advance up to 50% of Policy account value within 6 months

Product Details

Premium term |

Up to 100 years old (flexible premium payment from year 6th onward) |

Policy term |

Up to 100 years old |

Entry age |

0 - 65 years old |

Maturity benefit |

100% policy account value |

TPD benefit |

Max (sum assured, target premium account) TPD benefit + excess premium account |

Death benefit |

Max (sum assured, target premium account) + excess premium account |

Other Benefits |

Loyalty Bonus:

Investment Benefit: Terminal Illness benefit: Guaranteed Insurability Option:

|

Benefits

1. Guaranteed financial support for your family from 100% sum assured (SA) against risks of death/ Total and permanent disabilities (TPD)

PRU - WholeLife Cover financially protects you and your family against risks in life.

| Protection level (Sum Assured) against death/ TPD right from risk commencement date (1) |

Premium to be paid Illustrated for 35-year-old male Life Assured (LA) with health condition normal as per Prudential ‘s underwriting standard, SA Multiple 50 |

|

| Annual | Daily | |

| VND 600 million | VND 12 million | VND 33,000 |

| VND 1 billion | VND 20 million | VND 55,000 |

| VND 2 billion | VND 40 million | VND 110,000 |

- Receive an additional 100% SA if the LA’s death is due to Accident (2)

- Receive a zero-interest cash advance up to 50% of Policy Account Value (PAV) should the LA suffer from terminal illness. (3)

- Protect the whole family in 1 policy through attachment of various riders.

2. Safe and effective saving solution with guaranteed interest rate and attractive bonuses for loyal customers

With PRU - WholeLife Cover, you will be worry-free when your saving always grows safely and effectively.

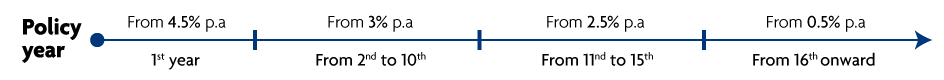

- Worry-free with guaranteed crediting rate during the whole policy term. Under any circumstances, the crediting rate is assured to be not lower than the guaranteed minimum crediting rate as follow

- Earn interest rate based on performance of the Universal Life Fund

The interest rate of the Universal Life Fund is publicly announced quarterly on website www.prudential.com.vn.Fund Performance report and Statement of Insurance policies are yearly sent to customers.

- Receive attractive loyalty bonuses to increase savings value of the policy (1)

- Equals 150% of one annualized target premium and shall be payable on the 10th Policy anniversary date.

- Equals 100% of one annualized target premium and shall be payable on the 13th Policy anniversary date.

- Equals 50% of one annualized target premium and shall be payable on the 16th Policy anniversary date and every 3 years thereafter.

3. Flexibility in managing your own saving plan and premium payment

PRU - WholeLife Cover will give you the flexibility and activeness in financial management to adapt to the changes of protection and saving needs during different life stages.

| Top-up | Withdraw cash | Flexible payment | Flexibly choose sum assured | Choose time to terminate the policy |

| Anytime to earn interest(1) | Flexibly realize different plans(2) | As per your financial capability(3) | Depending on your needs of protection(4) | As per your future needs(5) |

Special:

- Exempt from heath underwriting when increasing SA on following occasions: LA’s marriage, LA’s having babies / child adoption, LA’s child joining elementary, secondary, high schools or university(6)

- SA ranges from 10 to 150 times of Target Premium, depending on the protection needs and the age of LA.

Terms and Conditions apply, click here

Disclaimer:

All of features and insurance benefits presented hereunder are of summarized nature and for reference only. All features and conditions thereof shall be carried out in accordance with the terms and conditions as approved by the Ministry of Finance. Please carefully study the terms and conditions to master your benefits and products’ features. This plan is underwritten by Prudential Vietnam Assurance Private Limited. United Overseas Bank (Vietnam) Limited shall not bear any responsibility or liability for the plan or the products and services offered by Prudential Vietnam Assurance Private Limited.