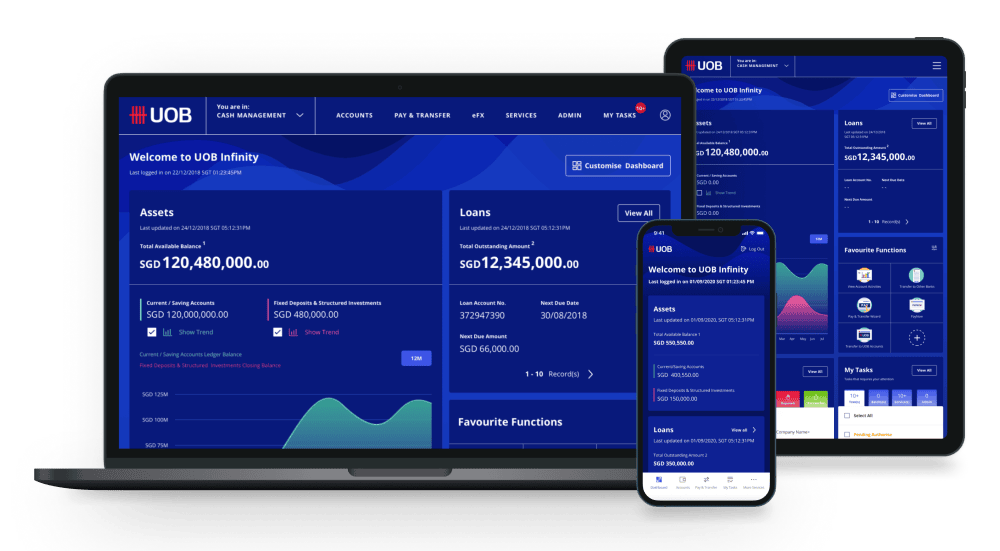

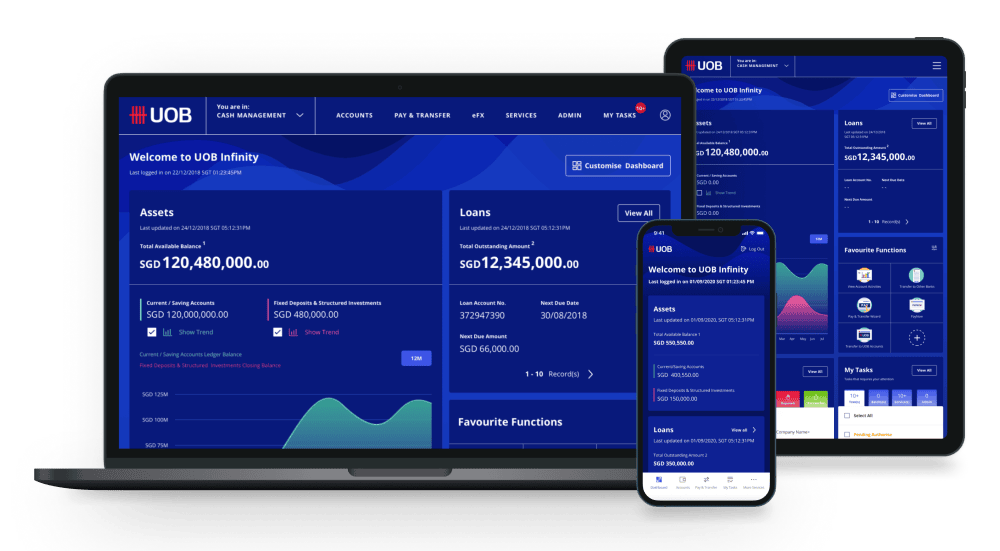

Ho Chi Minh City, 6 June 2025 – UOB Vietnam today announced the launch of its new Financial Supply Chain Management (FSCM) capabilities on UOB Infinity – the bank’s digital banking platform for businesses.

These new capabilities will enable UOB’s FSCM solutions to be delivered digitally, covering the entire supply chain cycle – from procurement to payment, production to sales, and invoicing to collections – all within a single, integrated platform.

According to the UOB Business Outlook Study 2024 (Vietnam) , Vietnamese businesses are increasingly realising the critical importance of strategic supply chain management. About 94 per cent of respondents acknowledged that effective supply chain management is important to their business, outpacing their regional counterparts in this awareness. More than four in 10 companies are seeking connections with the right technology and solution providers, or easier access to bank funding or grants, to ensure supply chain stability.

Across the key ASEAN markets including Indonesia, Malaysia, Singapore, Thailand and Vietnam, it was a similar story with 90 per cent of the region’s companies saying that supply chain management is important.

In response, more businesses across the region are adopting tools that help them manage their supply chains more efficiently, particularly through digital platforms.

UOB Infinity’s FSCM feature had earlier been launched in Singapore, Malaysia, Indonesia, Thailand, mainland China and Hong Kong. With the launch in Vietnam, all of UOB’s major markets have been covered, cementing the Bank’s leadership in supply chain financing across Greater China and ASEAN.

Across the region, there has been strong uptake of the FSCM feature on UOB Infinity. In 2024, the number of anchor clients grew by 150 per cent year-on-year, while the number of spokes onboarded increased by 430 per cent. These were accompanied by a ten-fold rise in digital trade invoices year-on-year and a 33 per cent increase in digital trade finance activities.

Ms Pham Van Khanh, Head of Transaction Banking, UOB Vietnam, said, “Vietnam continues to attract growing interest from businesses seeking to diversify and strengthen their supply chain operations. As businesses expand their manufacturing and sourcing networks, our end-to-end digital solutions provide the tools necessary to optimise working capital management, improve cash flow, and strengthen risk control within their supply chain ecosystems. Today’s launch underscores UOB’s commitment to supporting ASEAN connectivity and our ambition to be the number one cross-border trade bank across the region.”

By integrating FSCM capabilities into UOB Infinity, corporate customers in Vietnam can now manage cash, trade and FSCM transactions with a single login, enhancing convenience and visibility.

With the new FSCM feature, corporate clients can digitally connect with their supply chain ecosystem partners, including buyers, suppliers and distributors in Vietnam, across ASEAN and in Greater China. They can seamlessly submit trade documents and initiate financing requests at various stages of the supply chain such as pre- and post-shipment supplier financing, distributor financing and accounts receivable purchasing. This strengthens supply chain efficiency, resilience and inclusivity to support business growth.

The FSCM feature also improves operational efficiency and financial management by:

- providing real-time transaction tracking

- reducing manual trade document submissions

- streamlining payables and receivables reconciliation

- automating invoice processing and financing requests

- offering customisable risk management parameters

With the integration of FSCM capabilities into UOB Infinity, UOB reaffirms its commitment to empowering businesses in Vietnam and the region with seamless, digital-first solutions that drive supply chain resilience and sustainable growth.

UOB Vietnam commenced operations officially on 2nd July 2018. It is a wholly-owned subsidiary of UOB, a leading bank in Asia with a global network of more than 470 branches and offices in 19 markets in Asia Pacific, Europe and North America.

UOB has been in Vietnam for 30 years, started from a representative office in 1993 and became the first Singapore bank to launch a branch in the country in 1995. Today, UOB Vietnam offers a range of personal and institutional financial services to both Vietnamese and overseas customers across the country backed by the seamless connectivity offered through UOB’s regional network. In 2019, UOB Vietnam expanded into northern Vietnam with a branch in Hanoi. With the completion of the acquisition of Citibank Vietnam’s consumer banking business early 2023, UOB now has a total five branches in Ho Chi Minh city and Hanoi.

Over more than eight decades, generations of UOB employees have carried through the entrepreneurial spirit, the focus on long-term value creation and an unwavering commitment to do what is right for our customers and our colleagues.

We believe in being a responsible financial services provider and we are committed to making a difference in the lives of our stakeholders and in the communities in which we operate. Just as we are dedicated to helping our customers manage their finances wisely and to grow their businesses, UOB is steadfast in our support of social development, particularly in the areas of art, children and education.