Vietnam continues to affirm its position as a key destination in the regional M&A landscape as we enter 2025, serving as a gateway connecting global FDI capital with ASEAN. The global supply chain restructuring wave is driving a shift from purely financial transactions to more strategically oriented M&A. This new trend prioritizes companies with a clear ESG capacity, sustainable growth potential, and the ability to deeply integrate into regional networks.

Based on its stable macroeconomic foundation, ongoing legal reforms, and a strong outlook for green growth, Vietnam is not only attracting new capital but also maintaining its position as a central hub linking the ASEAN market with global investors. This is a critical time for businesses and investors to restructure their M&A strategies, leveraging advantages in connectivity, speed, and integration to create long-term value. UOB Vietnam is contributing to Vietnam’s M&A landscape through a variety of services, including trade finance, international payment support, and legal advisory procedures, backed by its superior experience and financial strength.

The M&A market in Vietnam began to take clear shape in the 1990s, but it was not until the 2005-2007 period that it truly became active. This surge was driven by Vietnam’s entry into the WTO, which provided a significant boost to foreign capital inflows, and the establishment of a legal framework with the effective implementation of the Enterprise Law (2005) and the Investment Law (2005). Over several decades, the domestic M&A market has achieved considerable success, notably in attracting strong foreign investment into the national economy.

A review of Vietnam’s M&A market over the past five years reveals that, despite facing difficulties caused by the Covid-19 pandemic, the market has rapidly recovered and is now undergoing distinct changes.

The Evolution of Vietnam’s M&A Market

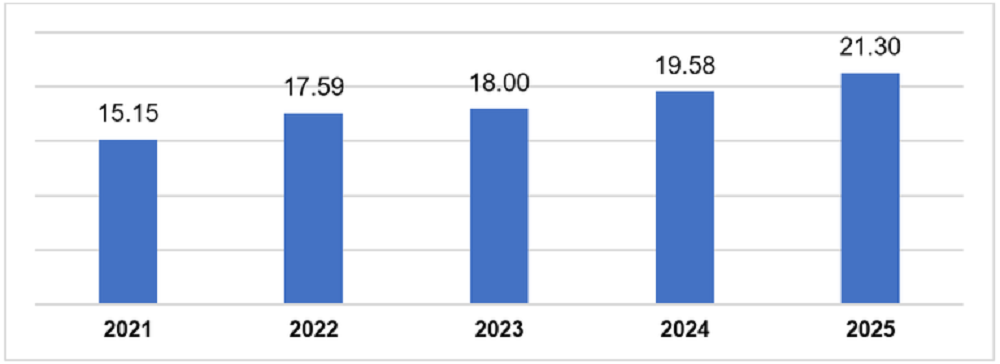

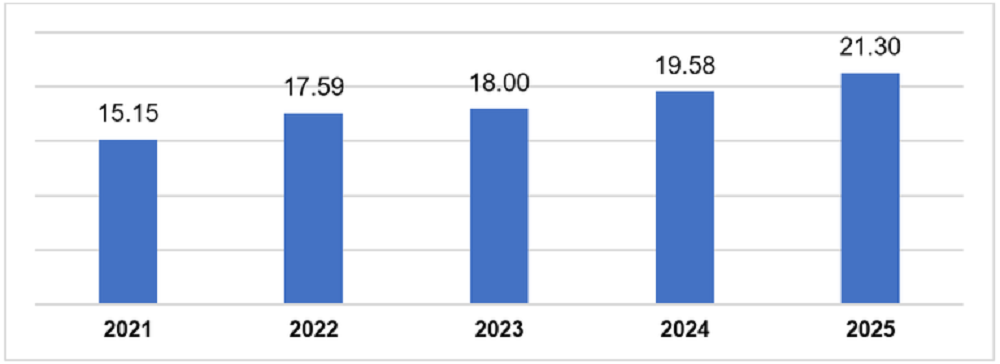

The M&A market is undergoing a qualitative shift, with the value of transactions continuing to increase. According to data from National Statistics office, Ministry of Finance, during January-October 2025, Vietnam disbursed USD 21.3 billion in FDI, up 8.8% compared to the same period (2).

Vietnam’s M&A market has recorded numerous high-value transactions over the past five years. Source: baochinhphu.vn

This demonstrates the appeal and significance of M&A in Vietnam, amid fundamental market changes driven by both intrinsic and external demands of the economy.

After the pandemic, many Vietnamese businesses faced difficulties, including risks in cash flow management and the dismantling of business profitability plans. They also faced stricter requirements for digital and green transformation, which are both costly and time-consuming to meet the rising demands of domestic and global markets.

Accordingly, M&A has become critical in addressing key issues: it helps businesses overcome difficulties; it is an effective solution for companies seeking to expand their resources, access technology to reach international markets, or divest non-performing assets to focus on core business areas. Meanwhile, foreign investors continue to dominate the M&A landscape. In 2024, domestic investors accounted for only 29% of the total market value, meaning foreign capital represented 71% (3). The preferences of foreign investors have shifted, with a greater focus on sustainability and the growth prospects of businesses.

While Vietnamese businesses are seeking new and abundant capital to enhance their management capabilities and modernize technology, FDI flows are eager to find companies with clear development strategies and strong potential to gain access to the Vietnamese market – using Vietnam as a strategic location to expand into the Southeast Asian region amid increasing tariff pressures. The convergence of interests from both sides has opened up new dynamics for Vietnam’s M&A market.

From a Financial Tool to a Corporate Repositioning Strategy

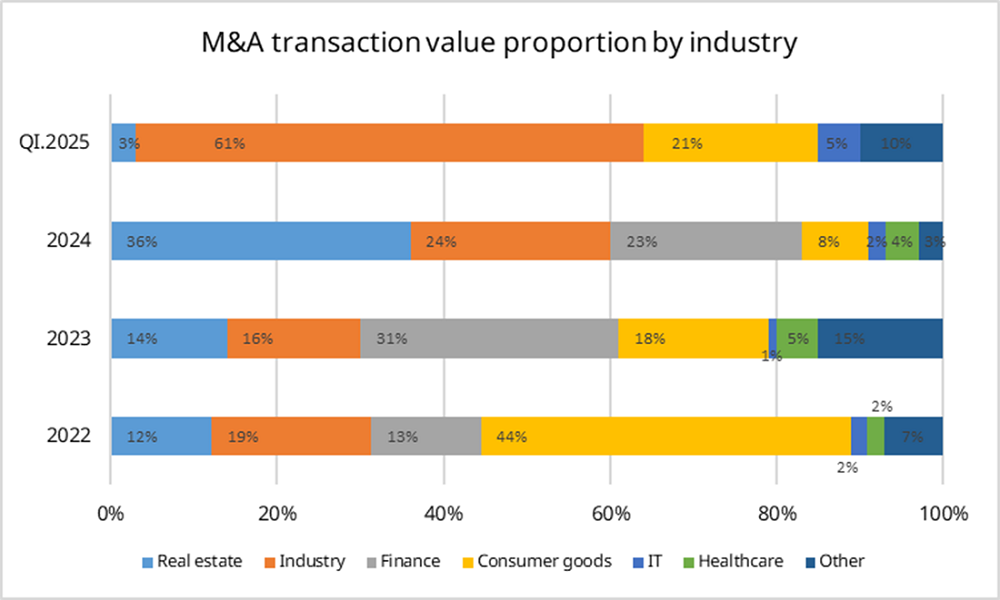

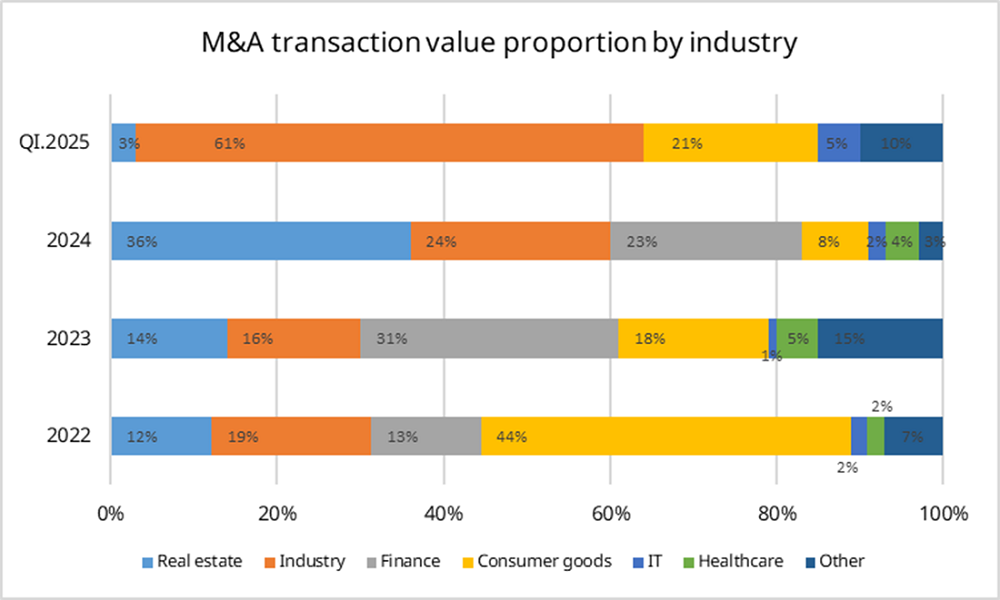

Instead of focusing solely on the retail and consumer sectors as in previous years, the industrial sector is now attracting significant attention from foreign investors. According to data from Grant, in 2022 the consumer goods sector accounted for 44% of the total value of publicly announced domestic transactions, while the industrial sector made up only 19%. By the first quarter of 2025, however, the industrial sector’s share had surged to 61%, followed by the consumer goods sector at just 21% (3).

Source: Capital IQ, Grant Thomton analysis

Among these trends, businesses focusing on green and sustainable practices are also attracting greater interest from the M&A market. In fact, compliance with environmental protection and sustainable development commitments is becoming an essential and mandatory requirement for global enterprises. Vietnam made a strong commitment at COP26 to achieve net-zero greenhouse gas emissions by 2050 (5). Combined with its significant potential for clean energy like solar and wind, as well as policies supporting green FDI capital, Vietnam has numerous opportunities to attract these capital flows. According to a forecast from PwC, green energy and sustainable development will be central to Vietnam’s M&A trends in 2025 (6).

M&A capital flows are also increasingly originating from Asian markets. In 2024, Singapore was the leading foreign country in terms of M&A deal value in Vietnam, accounting for 16% of the total transaction value (3). However, in the first six months of 2025, South Korea emerged as the leader in both the number of capital adjustments and the value of capital contributions and share purchases, with 18.5% and 26.5%, respectively (4). According to many experts, this year M&A capital will flow more from Japan, South Korea, Singapore, and the U.S., which were previously impacted by Covid-19.

M&A in Vietnam is clearly shifting in line with international investment trends. This new dynamic is characterized by a focus on sustainability, greater diversity in industry and investor structure, a rise in high-value transactions, more flexible deal formats, and a strong emphasis on strategic M&A. These strategies are focused on long-term goals, fostering stable development for both parties by reducing time and creating synergistic strengths.

Many deals have the explicit objective of restructuring businesses, which can include increasing scale, expanding market share, or optimizing input and output costs. This often involves integrating acquired companies into their own systems to create synergies and focus on developing core business systems. Other investors choose to acquire only strategic stakes of 20–49%, preserving the brand and operations in Vietnam while leveraging the existing advantages of the business to seek long-term benefits.

Ultimately, M&A activity is transitioning from a financial support tool for effective financial management to a tool for strategic corporate repositioning. The formation of alliance and partnership models is also helping participating parties in M&A leverage each other’s strengths for growth.

UOB Vietnam has also made significant contributions to this market through several major mergers and acquisitions to expand its retail and wealth management businesses in the ASEAN market.

Beyond conducting M&A, our bank is actively making major contributions to Vietnam’s M&A sector by employing strategies that strongly attract FDI capital. Over the past five years, our FDI Advisory unit has supported over 340 foreign-invested companies in expanding their operations in the Vietnamese market, with committed investments exceeding SGD 8 billion and the expected creation of approximately 53,000 jobs.

We also offer additional support services to FDI enterprises in general, and to those involved in the purchase of FDI enterprise capital in particular, across various ASEAN countries. This is made possible by our robust resources and extensive connectivity, as we possess a network in numerous countries in the region.

Opportunities and Risks in the M&A Market

The Government of Vietnam has determined that the M&A market plays a vital role, bringing outstanding value not only to businesses themselves but also in restructuring the economy, increasing the efficient use of social resources, and contributing to national growth. Accordingly, Vietnam is facing many favorable conditions for foreign capital to flow into this market.

Our bank has several advantages to best support FDI clients in Vietnam.

A stable macroeconomic environment with a target growth of 8% this year, coupled with a secure political landscape, allows the Government to implement numerous reforms-from operational mechanisms to legal policies-emphasizing the private sector as a key focus. Many of Vietnam’s policies are being amended to be more favorable to foreign capital inflows, such as increasing the foreign ownership limit in Vietnamese banks to 49% to promote financial sector M&A, and facilitating efforts to upgrade the stock market, with the expectation of attracting foreign capital into various sectors.

The M&A market in Vietnam presents significant challenges due to regulations governed by multiple laws. Foreign enterprises need to:

- Prepare complete documentation

- Have a solid understanding of Vietnamese law

- Ensure strong execution capabilities and strategic vision

These are critical factors to mitigate risks and ensure sustainable success in any deal.

UOB Vietnam – A Strategic Bridge for Foreign Investors

UOB Vietnam has made strong contributions to Vietnam’s M&A sector. We not only invest directly in this field but also accompany FDI enterprises in pursuing M&A deals, acting as a connector and advisor to enhance the value of M&A capital flows, and serving as a key channel for FDI capital in Vietnam.

In 2013, UOB Vietnam was one of the pioneering banks to establish an FDI Advisory unit in Vietnam to support trade and FDI flows. Since 2015, UOB Vietnam and the Vietnam Foreign Investment Agency (FIA) have signed and subsequently renewed their first Memorandum of Understanding (MOU) with the aim of strengthening FDI and trade between Vietnam and Southeast Asia. UOB Vietnam was also the first foreign bank to be recognized by the Ministry of Planning and Investment for its contributions to attracting FDI.

For years, UOB Vietnam has supported M&A deals in overcoming legal and funding barriers to enter the market. After completion, we provide trade finance, international payment solutions, supply chain management, and legal and tax advisory to help businesses optimize cashflow and mitigate currency risks.

Specifically, we offer our clients the following services:

FDI Strategic Advisory and M&A Support:

UOB Vietnam can assist with connections to government agencies, associations, and local partners, as well as help to identify investment standards, regulations, and legal frameworks - enabling investors to make accurate investment decisions.

Trade Finance Services:

We offer capital support and comprehensive solutions to help reduce risks in international trade. These services enable businesses to manage cash flow effectively after a merger, including Guarantee loans, Import-export financing, Letters of Credit (L/C), Pre- and post-shipment financing.

Green Sector Capital and ESG Support:

UOB Vietnam offers preferential capital policies for green sectors with competitive interest rates. We also provide ESG transformation support for businesses post-M&A to help them achieve sustainable development. Read more on How UOB’s tailored green finance solutions are helping turn sustainability goals into measurable business outcomes.

Supply Chain Finance Solutions:

We offer post-M&A cash flow optimization support through services such as: Supplier financing and Receivables financing.

Entering the second half of 2025, Vietnam’s M&A market is forecasted to see significant improvements, driven by capital flows from Japan, South Korea, Singapore, and the U.S., thanks to the country’s promising economic growth outlook.

The M&A market in Vietnam also increasingly demands solid experience and knowledge from participants, given the current volatile landscape with issues like tariff changes and shifts in FDI flows. Building on these strengths, UOB Vietnam is confident in its ability to provide optimal support to FDI enterprises participating in the M&A market - helping them capitalize on the growth wave and achieve sustainable development.

Learn more investment information and opportunities with UOB Vietnam

This article shall not be copied, distributed or used by any individual or organization for whatever purpose. This article is given for reference only, non-binding, and is strictly for information only. The information contained in this article is based on certain assumptions, information and conditions available as at the date of the article and may be subject to change at any time without notice. You should consult your own professional advisers about the issues discussed in this article. Nothing in this article constitutes accounting, legal, regulatory, tax or other advice. This article is not intended as an offer, recommendation, solicitation, or advice to purchase or sell any investment product, securities or instruments.

United Overseas Bank (Vietnam) Limited and its employees have made reasonable efforts to ensure the accuracy and objectivity of the information contained in this article, however, no representation or warranty, whether express or implied, is given as to its accuracy, completeness and objectivity and accept no responsibility or liability for any error, inaccuracy, omission or any consequence or any loss or damage howsoever suffered by any person arising from any reliance on the views expressed and the information in this article.