Exchange rate fluctuations demand a strategic shift in how businesses approach financial risk - moving from a reactive mindset to proactively developing robust cash flow management strategies. Rather than waiting for volatility to trigger concern businesses must anticipate potential risks and implement systems that safeguard liquidity, ensure operational stability, and support long-term financial resilience in a dynamic foreign exchange environment.

Exchange Rates Consistently Pose a Challenge for Domestic Import-Export Businesses

In simple terms, exchange rate is the ratio used to convert one currency into another. Specifically, the USD/VND exchange rate indicates how many Vietnamese Dong (VND) are needed to exchange for one US Dollar (USD).

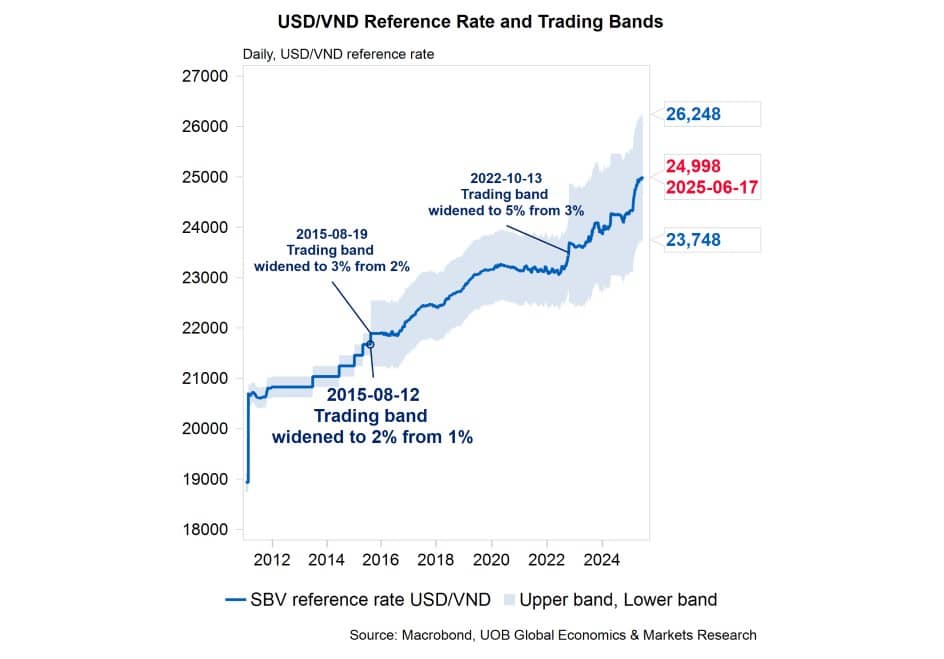

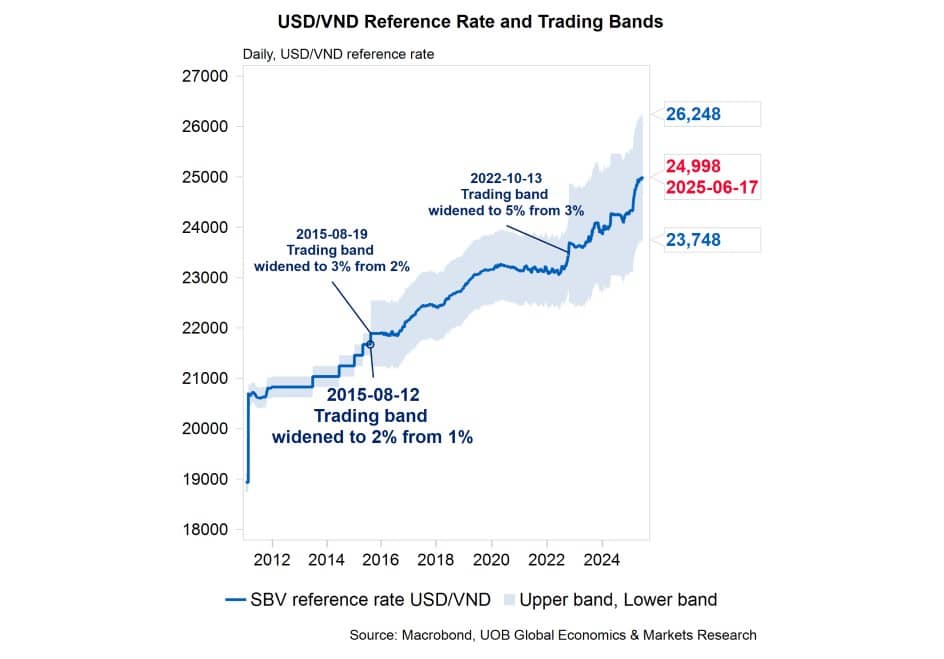

In Vietnam, based on government policy, the State Bank of Vietnam (SBV) announces a daily central USD/VND exchange rate to serve as a benchmark. Commercial banks then determine their own buy-sell rates within a current permitted fluctuation band of ± 5% from the central rate, depending on actual market supply and demand. These rates are publicly listed by commercial banks for a variety of foreign currencies. At UOB Vietnam, we publish our daily exchange rates against the Vietnamese Dong in the morning and update them in real time, including both buying and selling rates for telegraphic transfer and cash (on-demand) transactions. Clients can also contact us directly for the most up-to-date exchange rates. For nearly a century, the US Dollar (USD) has remained the dominant currency in global trade - accounting for approximately 58% of global foreign exchange reserves (Q4/2024, IMF COFER) and about 49% of global payment transactions (SWIFT). As a result, fluctuations in the USD/VND exchange rate have significant implications for businesses, individuals, and national economic indicators. Central banks worldwide prioritize exchange rate stability to ensure alignment with both domestic and global economic flows.

Exchange Rate Volatility

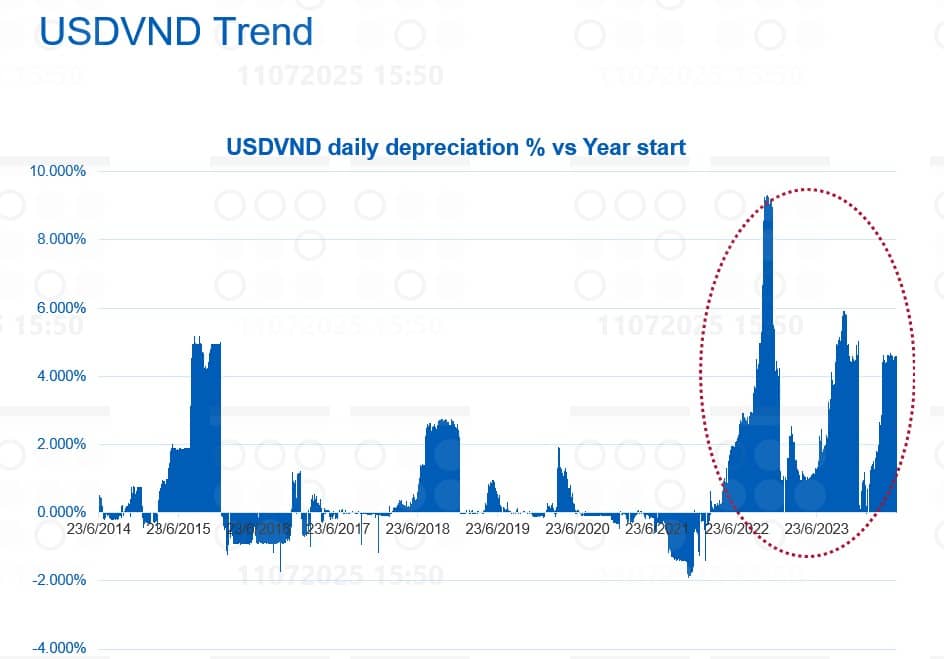

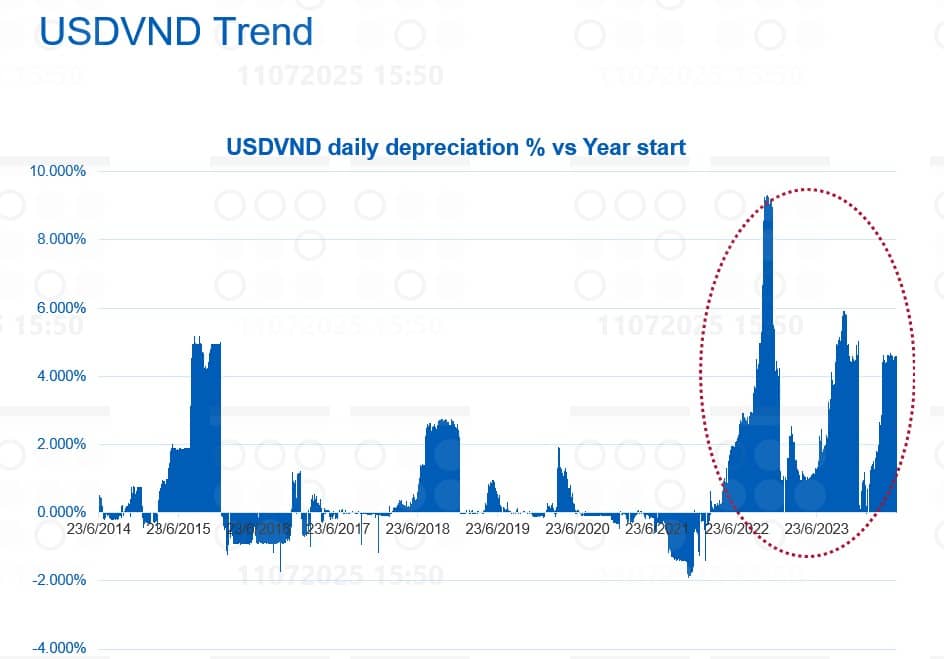

Managing exchange rates is a major challenge for policymakers due to global uncertainties and uncontrollable factors such as geopolitical conflicts, monetary policy shifts, and trade disputes between countries or regions. For instance, the Russia - Ukraine conflict that began in 2022 disrupted global supply chains and triggered inflationary pressure across many economies. In response to surging inflation, the U.S. Federal Reserve (FED) raised interest rates aggressively-by over 4% in 2022 alone, starting in March. This supported the USD to appreciate significantly against other currencies. In Vietnam, the USD/VND exchange rate reached a peak of approximately VND 24,870 per USD by November 2022. At its weakest point, the Vietnamese Dong depreciated by nearly 9% year-to-date, the sharpest decline among Southeast Asian currencies. To stabilize the market, the SBV raised the USD selling price and widened the exchange rate trading band from ±3% to ±5% on October 17, 2022 - it has been the first adjustment since August 2015.

From 2022 to 2025, the USD/VND exchange rate continued its upward trajectory

(Source: UOB Group’s Global Economics & Market Outlook Report).

Percentage of daily change in USD/VND exchange rate. Data from Refinitive.

Following this, from late 2023 to mid-2024, the armed conflict in the Middle East escalated with the Israel-Hamas war breaking out on October 7, 2023. Meanwhile, the FED maintained its elevated interest rates - an approach sustained since the pandemic - causing the DXY index to rise significantly (DXY index measures the value of the US Dollar relative to a basket of six major global currencies: the Euro, Japanese Yen, British Pound, Canadian Dollar, Swedish Krona, and Swiss Franc). By late 2024 and early 2025, the DXY index surged to 110, while the USD/VND exchange rate in Vietnam surpassed its previous peak, reaching VND 25,480 per USD by end year 2024.

In 2025, a new concern arose with the U.S. introducing retaliatory tariffs against its global trading partners. President Donald Trump announced tariffs of up to 46% on goods imported from Vietnam, upon starting his second term. This has put further pressure on the USD/VND exchange rate, as higher USD buying demands from domestic enterprises for raw materials import during a 90-day pause period before the tariffs took effect. Additionally, during the first 5 months of 2025, the State Treasury had purchased over USD 1.8 billion - nearly equal to all of 2024’s USD purchases - further intensified exchange rate pressure.

While the DXY index began to decline in early 2025, the domestic USD/VND exchange rate continued to rise. The FED has not provided a timeline for interest rate cuts, preferring to monitor conditions before adjusting its policy. As a result, the USD/VND exchange rate has continued to climb. In June 2025, the USD reached a record high on the free market, surpassing level VND 26,000/USD, with the potential to reach even higher.

The foreign exchange market is highly sensitive to global macroeconomic and geopolitical fluctuations - factors that lie largely beyond the control of the Vietnamese Government and the State Bank of Vietnam (SBV). Vietnam’s economy is highly open, with total import-export turnover nearly double its GDP. Adding to the pressure is the Vietnamese public’s tendency to hold foreign currencies like the USD as a store of value, and businesses’ preference to retain foreign currencies for future transactions rather than selling them. Despite the SBV’s deep experience and wide array of monetary policy tools, these conditions present significant challenges in maintaining exchange rate stability and ensuring an adequate supply of foreign currency for the economy.

Businesses Are Facing Challenges

In practice, import-export businesses face more than just the challenge of securing orders and maintaining operations - they must also manage risks related to exchange rate volatility. For importers, rising exchange rates mean spending more Vietnamese Dong to buy the same amount of foreign currency to pay for goods. This squeezes profit margins, especially since raising prices can reduce competitiveness. Exporters may seem to benefit, but many industries - such as footwear and textiles - still rely heavily on imported machinery and raw materials. These dependencies, combined with ongoing U.S. tariff pressures, mean profits often fall short of expectations. Moreover, businesses with USD-denominated debt face added financial strain as the Vietnamese Dong continues to weaken.

Many textile and garment businesses in Vietnam are impacted by exchange rate fluctuations due to their reliance on imported raw materials and machinery.

Effective cash flow management is vital for businesses. Consistently high exchange rates will increase financial costs for businesses, potentially impacting cash flow, the ability to ensure payments, access to and utilization of capital. Without proper preparation, businesses could bear cash flow shortage risks, unprofitable operations, and falling stock value and market capitalization. That is the reason why UOB Vietnam continues to offer innovative credit, trade, liquidity, and cash flow solutions to help businesses manage financial risk effectively. While some businesses - such as exporters of rice, coffee, and vegetables - have benefited from rising exchange rates due to low dependence on imports, experts have warned against viewing these gains as mere “luck.” Sustainable profitability requires strategic planning, supply chain expansion, and market diversification.

Currently, the SBV consistently maintains its stance on stable and controlled exchange rate management, carefully balancing exchange rate trade-offs with interest rate reduction, and flexibly adapting to global changes. The core issue, however, still lies with businesses and, primarily, begins with a shift in mindset. Instead of passively reacting or solely relying on regulatory policies, business owners need to proactively develop responsive measures, ready to adapt to any potential fluctuations.

Addressing Exchange Rate Risk Mitigation

To adapt effectively, businesses must first adjust their production strategies. This includes strengthening internal capabilities, pursuing innovation, and identifying local suppliers or new export markets to reduce reliance on specific countries or imported inputs. The robust growth of the banking sector is enabling it to offer numerous financial services and solutions in the foreign exchange market, helping businesses mitigate exchange rate risks. Among these, FX Forwards (Foreign exchange forward contracts) and FX Swaps (Foreign exchange swap contracts) are primary examples. Additionally, interest rate derivatives such as Interest Rate Swaps (IRS), Cross Currency Swaps (CCS), and interest rate options are also available.

UOB Vietnam offers a range of services designed to support businesses in developing sustainably against exchange rate fluctuations.

FX Forward Contracts: This financial tool allows businesses to lock in a pre-agreed exchange rate for buying or selling a specified amount of foreign currency on a specified future date. This eliminates uncertainty about future rates and secures predictable cash flows. FX forwards can have terms of up to one year.

Cross Currency Swaps (CCS): A CCS enables businesses to swap floating payment obligations in one currency (e.g., USD) for fixed obligations in another (e.g., VND). This dual-purpose tool helps mitigate both exchange rate and interest rate risks while stabilizing borrowing costs. UOB Vietnam offers CCS terms of up to 5 years, customized to match each business’s exposure. At UOB Vietnam, businesses will receive specific advice on cross currency swaps that matching with the risk arising from the underlying transactions (for example, an offshore loan).

Interest Rate Swaps (IRS): An IRS converts floating interest payments to fixed payments within the same currency. This is ideal for companies with large or long-term loans or having cashflow with high reliance on rate fluctuations, offering stable interest costs and improved cash flow predictability. UOB Vietnam will advise businesses on tenors and notional amounts for matching with their demands on risk preventions. Compared to CCS, IRS products typically provide better liquidity and longer protection terms (5+ years).

Interest Rate Options: This product allows businesses to pay a premium for the right - but not the obligation - to fix borrowing costs within a target range over a specified term. This protects against unfavorable interest rate shifts while allowing flexibility.

With over 500 branches across Asia-Pacific - including strong networks in Singapore, Malaysia, Thailand, Indonesia, and Vietnam - UOB brings regional insight and deep experience in partnering with both local enterprises and multinational corporations. Our advisory teams understand the unique needs of each business and offer personalized, efficient service backed by digital innovation. With a client base that includes large corporations and Foreign Direct Investment (FDI) firms, UOB Vietnam is proud of its extensive experience in partnering with both local and international businesses. We have supported many clients in managing their funds effectively and navigating unpredictable exchange rate fluctuations.

Contact us for further support and consultation

UOB Vietnam provides tailored solutions for business requirements to hedge against FX fluctuations

This article shall not be copied, distributed or used by any individual or organization for whatever purpose. This article is given for reference only, non-binding and is strictly for information only. The information contained in this article is based on certain assumptions, information and conditions available as at the date of the article and may be subject to change at any time without notice. You should consult your own professional advisers about the issues discussed in this article. Nothing in this article constitutes accounting, legal, regulatory, tax or other advice. This article is not intended as an offer, recommendation, solicitation, or advice to purchase or sell any investment product, securities or instruments.

United Overseas Bank (Vietnam) Limited and its employees have made reasonable efforts to ensure the accuracy and objectivity of the information contained in this article, however, no representation or warranty, whether express or implied, is given as to its accuracy, completeness and objectivity and accept no responsibility or liability for any error, inaccuracy, omission or any consequence or any loss or damage howsoever suffered by any person arising from any reliance on the views expressed and the information in this article.