You are now reading:

The importance of risk management for your business (Part 2)

you are in UOB Explore

You are now reading:

The importance of risk management for your business (Part 2)

1. Ensures Business Continuity

Key appointment holders/ shareholders of the business are valuable assets through their domain knowledge, personal relationships and financial commitments. Loosing them due to their departure may directly impact the bottom line or going concern of the business.

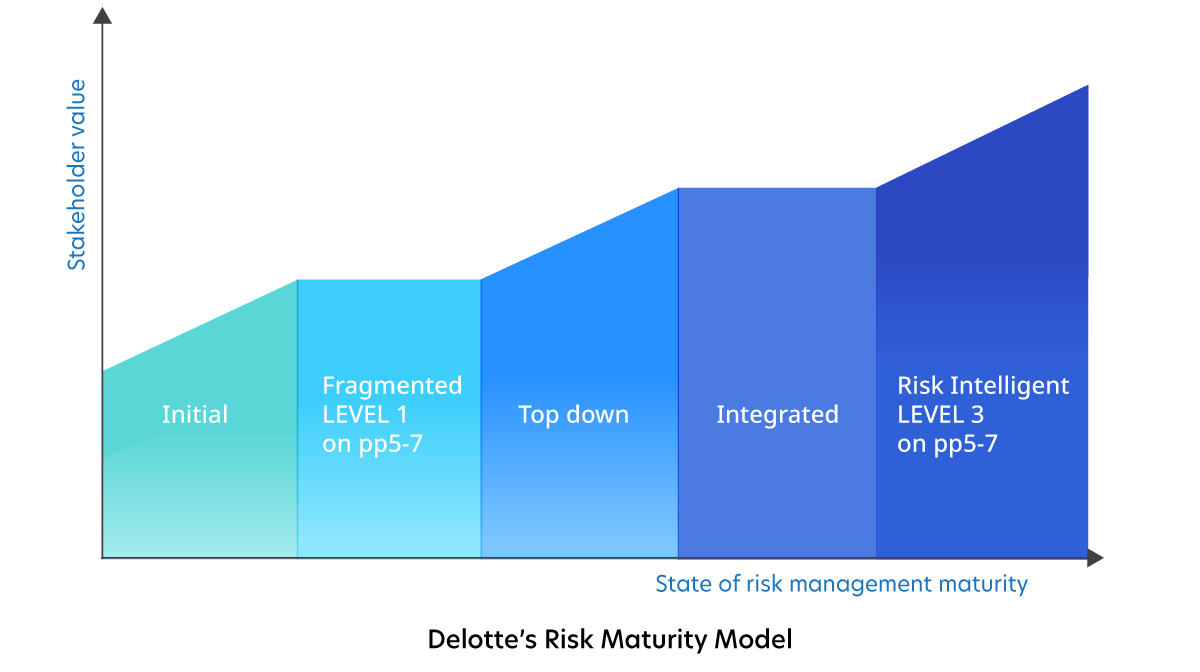

Based on the 2015 – 2016 survey on corporate risk management by Deloitte Vietnam(1), most businesses are yet able to proactively anticipate and deal with unexpected risks in a period of uncertainty and heightened operational complexity. According to Ms. Tran Thuy Ngoc, Deputy CEO of Deloitte Vietnam, Vietnam companies are at level 2 of the Deloitte’s Risk Maturity Model, which is “Fragmented”.

What this means is that most of Vietnam businesses consider risk management as a separate activity from commercial decision‐making and have tendency to monitor risks on an ad‐hoc basis. Hence, they are not well prepared to handle extra-ordinary situations.

When your business is doing well and everything seems smooth sailing, it is prudent for leaders to look at risk management and set aside resources to cater for the various scenarios in the future.

1.1 Customise Your Life Insurance Plan

When considering a life insurance plan for business, there are a few variables you can adjust to meet your requirements. Depending on the underlying purpose (e.g. insuring against a long term loan) and premium affordability, you may wish to speak to qualified financial advisor to adjust the sum assured, premium contribution period and break-even point from cash value perspective.

1.2 Insure Your Long Term Liability

With a positive outlook for your business, you may have obtained a long term project financing from your financial service provider. The pay back of the term financing is usually from the project cash flows and may be dependant on the keyman of the business. To contain the risks of your long term venture for instance, life insurance can be a useful tool to insure your keyman who are pivotal to the growth of business. The size of the sum assured can be injected to the business for repayment of loans when unfortunate event happens.

1.3 Buy Out Shares of Deceased Shareholder

For private companies and partnerships, it is very important to plan for eventualities. The company may prosper due to complementing partnerships and trust established over time between stakeholders. Due to unexpected departure of a key shareholder, you may be forced to look for an alternate investor or look for cash to buy out shares of deceased shareholder. Under such circumstances, you may dilute the control of your business and adversely affect its prospect.

In your opinion, when is a good time for your business to consider risk management?

All businesses are different and application of business life insurance to manage risk is both a science and an art. UOB Vietnam partners Prudential to provide quality solutions for both businesses and individuals. Drop us a note and speak to us today. It is never too late to start a meaningful discussion.

23 Sep 2020 • 2 mins read

07 Oct 2020 • 2 mins read

06 Oct 2025 • 4 mins read