You are now reading:

UOB Vietnam recognized among Top 10 Green Service Awards 2025

you are in Wholesale Banking

You are now reading:

UOB Vietnam recognized among Top 10 Green Service Awards 2025

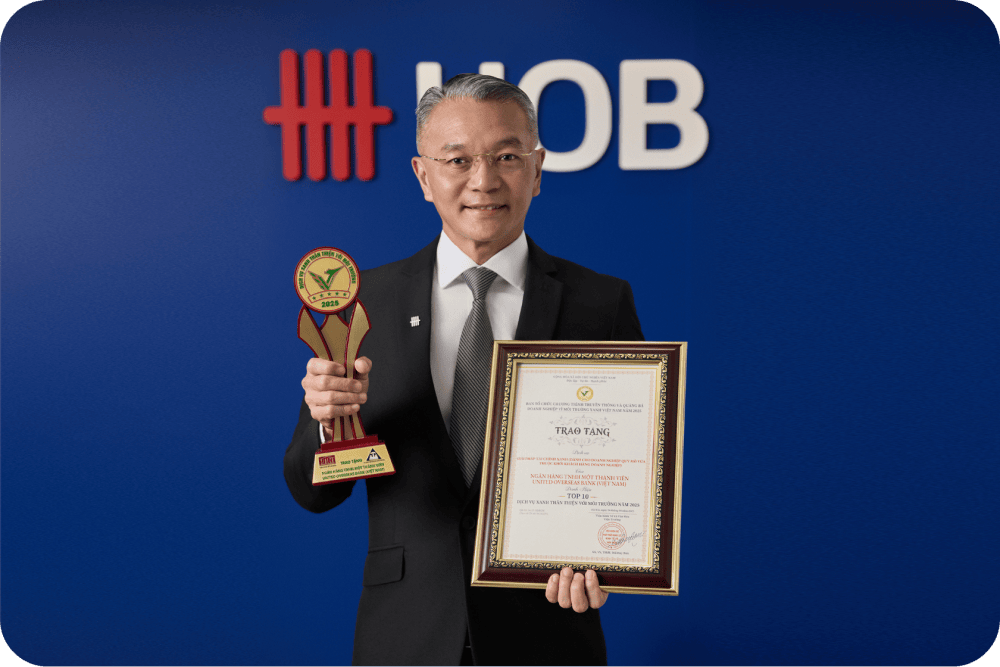

UOB Vietnam has been named among the "Top 10 Green and Environmentally Friendly Services 2025" (Finance - Banking category) at the 22nd edition of the "Enterprises for a Green Environment" Awards, organized by the Institute of Economics and Culture under the Ministry of Science and Technology.

Mr. Lim Dyi Chang, Country Head of Commercial Banking, UOB Vietnam

Enabling green transition amid intensifying climate challenges

According to UOB's 2024 Sustainability Report, Vietnam recorded extreme weather events over the past year, including temperatures exceeding 40°C, widespread drought, and severe flooding. These disruptions have posed significant challenges to businesses, compelling them to restructure operations to enhance long-term resilience and competitiveness.

At the same time, tightening ESG requirements from global export markets are placing greater pressure on Vietnamese enterprises, especially mid-sized firms, to adopt sustainable practices in order to maintain market access and secure international financing.

Practical green finance solutions tailored to local needs

In response, UOB Vietnam has rolled out a suite of green finance solutions aligned with the country’s operating conditions. Beyond capital, the Bank also provides ESG advisory and support for implementing transition initiatives and optimizing sustainable supply chains.

As of end-2024, UOB Vietnam has supported 19 green finance projects across renewable energy, sustainable manufacturing, and export-linked value chains. Most recently, the Bank signed a Green Trade Finance agreement with Nam Viet Corporation (NAVICO), supporting NAVICO’s Net Zero roadmap and elevating ESG standards across key export markets including Asia, Europe, the Americas, the Middle East, and beyond.

Strategic commitment for long-term impact

Looking ahead to 2025, UOB Vietnam aims to allocate 30% of new loan disbursements to sustainability-linked initiatives, with a strong focus on mid-sized enterprises. The Bank is also expanding its green finance offerings in priority sectors such as renewable energy, sustainable production, and smart urban infrastructure, key pillars of Vietnam’s economic transformation.

At the Group level, UOB has surpassed USD 41 billion in sustainable finance as of end-2024 and officially adopted the Taskforce on Nature-related Financial Disclosures (TNFD) framework, reinforcing its long-term commitment to nature-aligned investment and value-driven growth.

Mr. Lim Dyi Chang, Country Head of Commercial Banking, UOB Vietnam, stated: “This recognition affirms our long-term commitment to Vietnam’s sustainability journey. As a strategic financial partner, UOB combines green capital with practical support to help businesses navigate ESG challenges and build long-term resilience”.

UOB Vietnam at the 22nd ‘Enterprises for a Green Environment’ Awards - Full highlights