Throughout its formation and development, UOB Vietnam has accompanied many Vietnamese families on their journey to build a strong financial foundation for the next generation. Amidst a volatile economic landscape and rising costs, planning for your children’s financial future has become a top priority. By taking proactive steps now, you can safeguard family wealth, ensure long-term financial security, and empower your children to thrive in a rapidly changing world.

Discover 4 practical tips for effective financial planning and wealth accumulation to secure the next generation’s future.

Why is financial planning necessary for the successors?

Parents proactively establish long-term financial plans help reduce pressure on their children in the future

Ongoing socio-economic volatility is putting immense pressure on household budgets, especially for long-term expenses such as education, healthcare, and housing. As children grow, rising cost often leads parents to face mounting financial challenges. Implementing proactive financial planning for future generations early on helps families manage budgets effectively while building a strong foundation for children to achieve their academic and career goals.

4 pillars to build a financial plan for the next generation

Creating a financial plan early unlocks opportunities for long-term wealth accumulation and ensures lasting family security for future generations.

A family financial plan is truly valuable when it is tied to clear objectives and a specific roadmap. Here are 4 important pillars to consider:

1. Education fund: Building a strong foundation for your children’s future

The cost of quality education is rising, especially at international schools or for overseas study programs. Setting clear financial accumulation goals early helps parents proactively prepare resources, ensuring their children can access to environments that match their potential and future aspirations.

Phase 1 - From birth to 6 years old

This is the prime time for parents to start. A portion of monthly income (5-10%) should be allocated to the education fund or a separate savings fund for the child, prioritizing safe channels such as recurring deposits or educational insurance. The goal is to establish a habit of regular financial accumulation, making it easier for parents to control child-rearing costs in the early years.

Phase 2 - From 6 to 12 years old

This stage is to build your child's learning foundation and essential skills, while keeping your financial accumulation plan on track with sufficient resources for the next level of education. As children enter school, tuition fees and living expenses increase significantly. Parents should review and adjust their financial strategy to cover costs for private or international school tuition, foreign language courses, or soft skills development. Additionally, diversifying investment options – such as fund certificates – can improve accumulation efficiency and maximize potential returns.

Phase 3 - From 12 to 18 years old

This is the most critical phase as your children enter adulthood and map out their future academic or career path. If there is any plan for studying abroad or attending high-quality institutions, shifting to investment channels with stable earning potential such as equity investment funds, bond funds, or discretionary portfolio management should be considered.

2. Secure retirement: Peace of mind to enjoy your golden years

Preparing a retirement fund in advance ensures financial independence later in life. Proactive planning at early stages helps you better control resources and strive towards a safe, stable, and sustainable future.

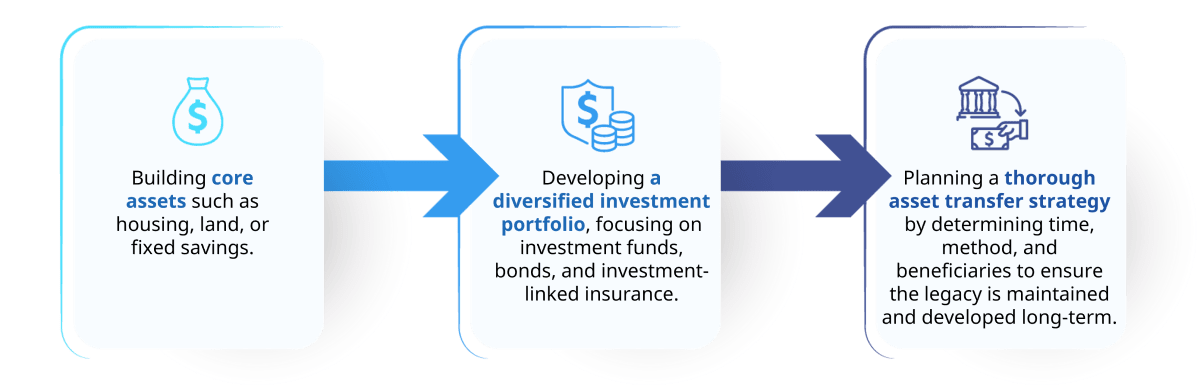

3. Financial legacy: Passing on lasting value

A sustainable financial plan is more than a strategy – it’s a way to create a lasting legacy for the next generation, reflecting the love, responsibility, and protection parents wish to provide. Building a legacy fund early helps families proactively manage resources, while giving children a strong foundation to grow independently and preserve family values.

The roadmap for creating and accumulating a financial legacy can start with:

4. Financial freedom: Opening the door to the future

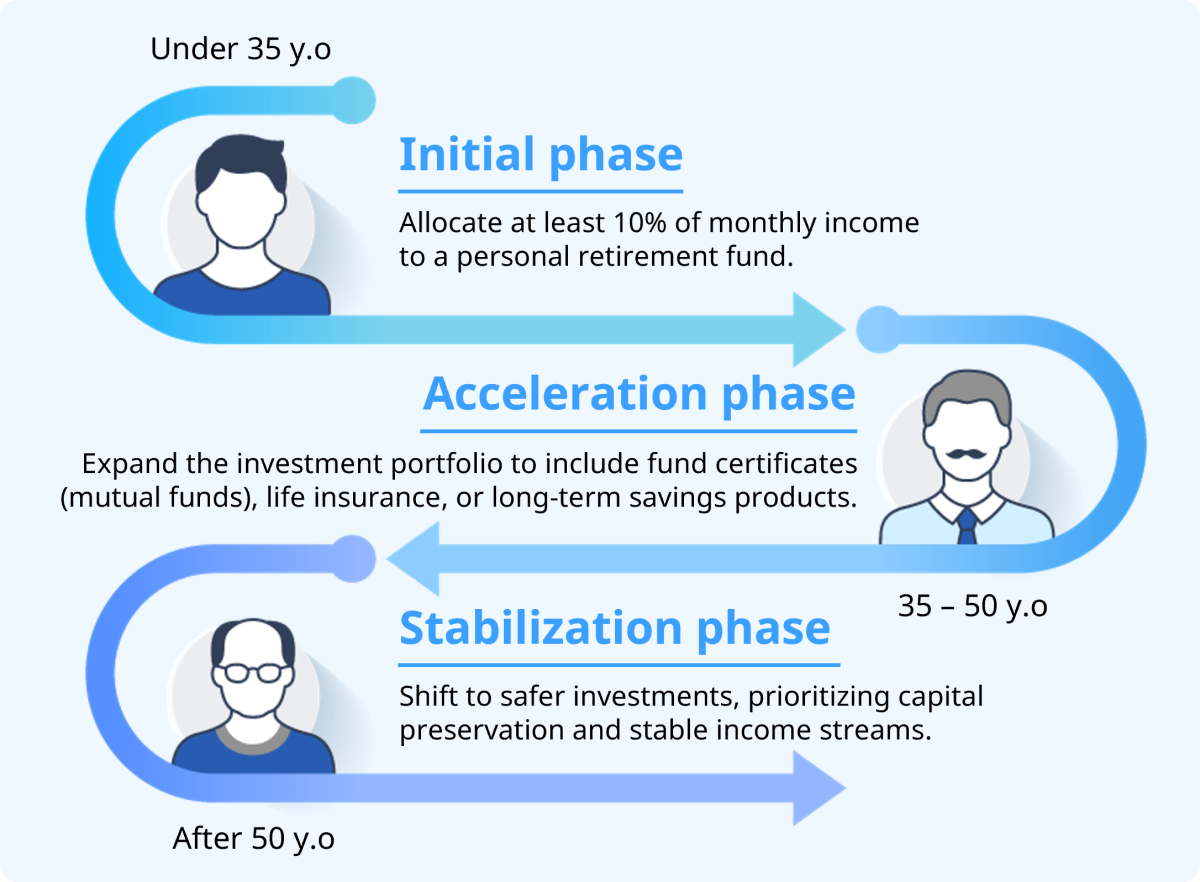

An effective financial plan needs to be divided into clear stages – from foundation building, asset growth, to financial autonomy. To achieve this, parents need a specific roadmap with distinct phases, aiming for sustainable and smart financial accumulation.

- Foundation building phase (first 10 years): Focus on stabilizing income, controlling expenditure, and creating the bedrock for the family's financial plan.

- Growth phase (next 10 - 20 years): Expand the investment portfolio, increase asset value, and optimize cash flow.

- Financial autonomy phase: Proactive in personal financial decisions, ready for long-term goals such as retirement, children's education, or asset transfer.

UOB Vietnam offers 4 professional financial accumulation options for the next generation

Each family can flexibly combine various forms of financial accumulation and investment, depending on their needs and financial capacity.

UOB Vietnam accompanies families with sustainable investment and financial accumulation solutions.

1. Bank savings: Safe and accessible

Bank savings is a safe method of financial accumulation, suitable for all stages of the financial plan.

At UOB Vietnam, customers can easily deposit, withdraw, and manage savings accounts dedicated to their children's future financial plans. With Privilege Banking, UOB Vietnam will accompany you in building a personal financial plan tailored to each life stage.

2. Life insurance: The foundation for a strong financial plan at every life stage

Proactive planning helps us protect ourselves and our family against risks, while also accumulating and investing for long-term goals.

Life insurance is a comprehensive solution, combining protection and accumulation. With flexible products like PRU-WHOLELIFE COVER and PRU-SAFE LIFE, UOB Vietnam accompanies customers through every life stage – from their child's early years to a comfortable retirement.

3. General Insurance: Lasting value over time

The strategic partnership between UOB Vietnam and Liberty Insurance Limited has provided customers with comprehensive financial protection solutions, helping you feel more secure on every journey in life.

- Liberty Autocare Insurance: This offers a comprehensive all risks coverage including physical damage, hydraulic lock, flooded vehicle, and partial theft, with guaranteed genuine parts replacement, giving you added peace of mind during heavy rain and storm season.

- Liberty HomeCare Insurance: This provides a comprehensive protection for your home, belongings, and other valuable assets, while also offering accident coverage for your family. With fast repair support, compensation for property replacement, liability insurance for third parties, and coverage for risks such as fire, theft, and natural disasters, it helps safeguard everything you have built and prevents life-changing financial losses.

- Liberty TravelCare Global Travel Insurance: This offers peace of mind with a wide-ranging protection for your worldwide trip against interruptions. It covers travel accidents, trip cancellations or delays, lost or damaged baggage, theft or robbery and medical expenses in Vietnam and abroad, including emergency treatment and hospitalization, ensuring you stay safe and supported.

Insurance is a "strong anchor" for individuals and families to feel secure amidst any volatility, confidently plan, and complete a financial plan for the next generation.

4. Investing in fund certificates: Flexible and risk-optimizing

Financial investment is not just for experience investors; anyone can start with the right support and guidance. Event without deep market expertise, you can confidently participate in investment portfolios such as the United ESG Vietnam Equity Fund (UVEEF), the United Dynamic Income Vietnam Fund (UVDIF), or Separately Managed Accounts (SAM) – all professionally managed by UOB Asset Management Vietnam (UOBAM Vietnam) with complete transparency.

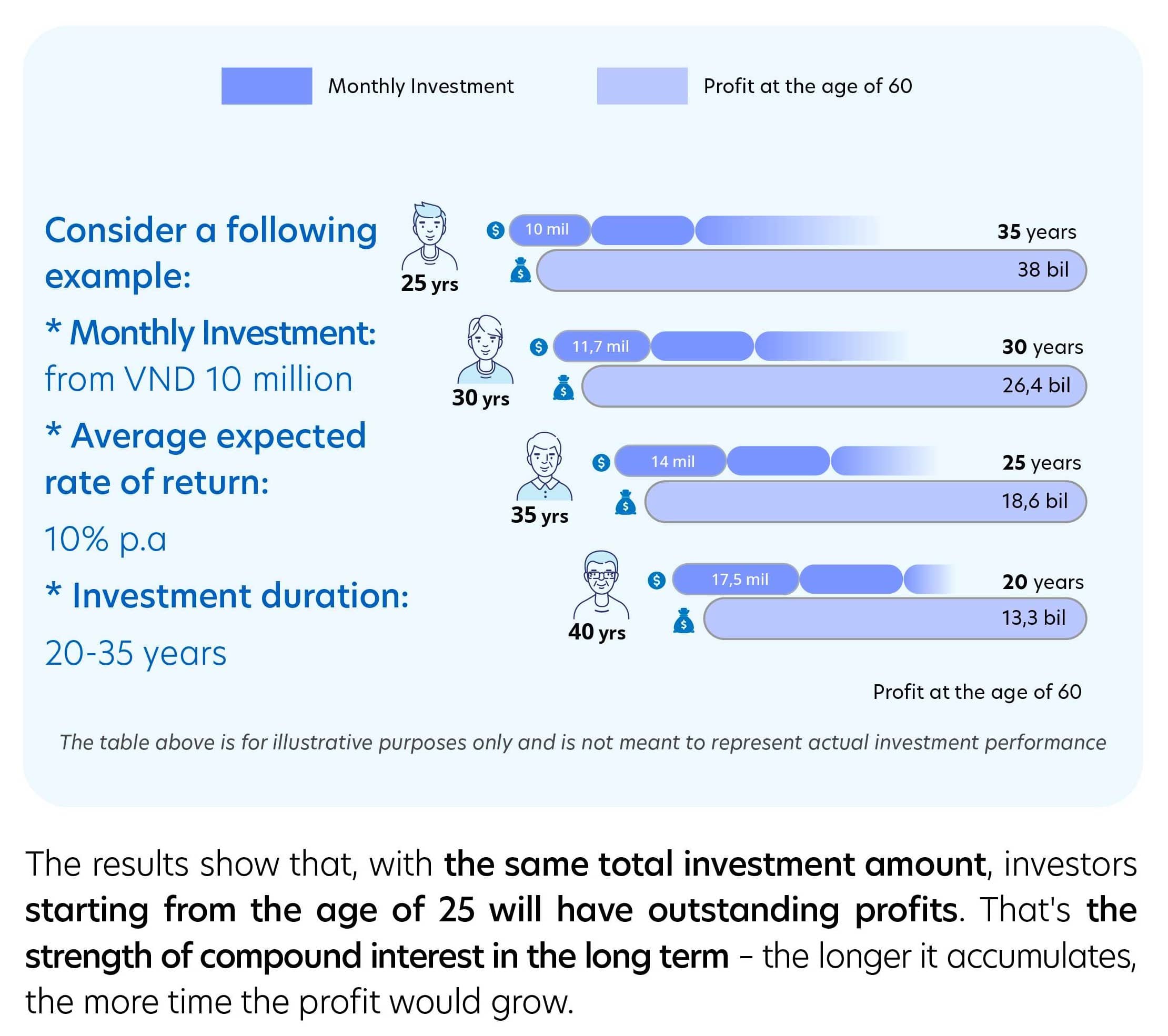

We are confident in accompanying investors – especially busy individuals – in making smart, safe, and sustainably profit-optimizing investment decisions. Below is an example illustrating the power of early financial investment and accumulation, following a clear and effective roadmap:

Why should we invest and accumulate finances early and long-term?

This example shows that time is a decisive factor in investment:

Mr. A and Mr. B both want to accumulate wealth for their children.

- Mr. A starts investing early at age 25, investing VND 10 million per month into an investment fund with an average rate of return of 10% per year. Mr. A only invests during the first 10 years (from age 25 to 35), then stops investing but allows the money to continue generating returns.

- Mr. B starts later, at age 35, and he invests a steady VND 10 million per month until age 60 (investing continuously for 25 years) with the same rate of return of 10% per year.

Result after 35 years (when both are 60 years old):

- Mr. A: The total investment amount is only VND 1.2 billion (VND 10 million x 12 months x 10 years). However, thanks to compound interest and the investment duration, Mr. A's money has grown to over VND 35 billion.

- Mr. B: The total investment amount is VND 3 billion (VND 10 million x 12 months x 25 years). However, because he started later than Mr. A, Mr. B's money only reached about VND 18.6 billion.

Therefore, time is the most important factor in investment. By starting early, even with small amounts, the results are superior due to the power of compound interest and time – two critical factors in the financial investment journey.

Conclusion

A clear family financial plan not only provides children with a strong foundation for the future but also helps you proactively enjoy a secure and autonomous life. UOB Vietnam is always ready to accompany you on the journey to build strong finances for the next generation.

Build the financial foundation today – Open the door to opportunities tomorrow!

Contact our team of experts for advice on a safe, flexible, and complete financial solution for your family.

This article shall not be copied, distributed or used by any individual or organisation for whatever purpose. This article is given for reference only, non-binding, and is strictly for information only. The information contained in this article is based on certain assumptions, information and conditions available as at the date of the article and may be subject to change at any time without notice. You should consult your own professional advisers about the issues discussed in this article. Nothing in this article constitutes accounting, legal, regulatory, tax or other advice. This article is not intended as an offer, recommendation, solicitation, or advice to purchase or sell any investment product, securities or instruments.

United Overseas Bank (Vietnam) Limited and its employees have made reasonable efforts to ensure the accuracy and objectivity of the information contained in this article, however, no representation or warranty, whether express or implied, is given as to its accuracy, completeness and objectivity and accept no responsibility or liability for any error, inaccuracy, omission or any consequence or any loss or damage howsoever suffered by any person arising from any reliance on the views expressed and the information in this article.