Frequently Asked Questions

All FAQs

UOB Infinity is UOB’s digital banking platform for businesses. The platform offers a comprehensive suite of cash management and trade services to help you manage your cash and trade transactions more efficiently.

Yes, UOB Infinity is available 24/7. However, some transactions may be subject to processing hours.

Yes, as long as you have Internet access while you are overseas, you will be able to access UOB Infinity anytime, anywhere.

Yes, you can access UOB Infinity via the UOB Infinity mobile app. You can download the mobile app from the App Store (for iPhones) or Play Store (for Android phones).

With the UOB Infinity mobile app, you can access your business account, make payments and authorise transactions anytime, anywhere.

Alternatively, you can access UOB Infinity using the browser from your mobile phone or tablet.

UOB Infinity offers new features to help you navigate and complete your tasks faster and more efficiently. With UOB Infinity, you will be able to:

- Personalise your dashboard and access information that matters most to you quickly.

- Access any function in just one click.

- Authenticate cash transactions anytime, anywhere without a physical token.

- Track end-to-end status of cross-border payments and enjoy visibility of all fees and charges.

No new login credentials are required. You can use the same login credentials for BIBPlus to access UOB Infinity.

Both UOB Infinity and BIBPlus will run concurrently to give users time to get used to the new user interface on UOB Infinity. All transactions, templates, past payments, drafts and payee/beneficiary master will be available on both platforms.

Sole proprietors/companies/clubs and societies that have a corporate account with UOB are eligible to apply for UOB Infinity.

For more information on UOB corporate accounts, please visit our website or the nearest UOB branch to your convenience.

Please contact your relationship manager or call us at:

- +84 28 3868 9700 (Local & Overseas) for Business banking clients

- 1800 558 880 (Local) / +84 28 3933 1999 (Overseas) for Wholessale banking clients

Yes, you can use your overseas contact number in UOB Infinity. UOB Infinity does not have restrictions and can send SMS to all countries' mobile number.

Fees and charges related to product and services such as NAPAS and Telegraphic Transfers will continue to apply.

Your Company Administrator will be able to create/add users and assign different functional and data access privileges to different users. However, the Company Administrator cannot create/add other Company Administrators and/or Authorisers.

To create/add Administrator and Authoriser access, please submit a maintenance form.

To link/add more accounts, please submit a maintenance form.

To subscribe to more UOB Infinity services such as bulk payment/payroll, MT103 copy and trade services, please submit a maintenance form.

You can activate your user ID from the UOB Infinity login page by selecting “Want to activate your new account?” and following the on-screen steps. For all users except Company Administrators and Authorisers, your Company Administrator will also be able to activate your account on your behalf.

For a step-by-step guide, please login to UOB Infinity, click the user icon ![]() at the top menu bar, and click “Need Help?”.

at the top menu bar, and click “Need Help?”.

- Organisation ID – You cannot change your Organisation ID

- User ID - You can change your User ID only during your first login to UOB Infinity. Subsequent changes are not allowed.

- Password – You may change your password at any time from the “Manage Profile” menu at the top right corner of your dashboard.

UOB Infinity has a “Remember Me” function to store the Organisation and User ID from the last login., so that you only need to enter your password the next time you login. However, the “Remember Me” function can only save one Organisation and User ID.

UOB Infinity can display account activity data for the past 12 months.

For existing BIBPlus customers, you will be able to view/retrieve account activity data for the past 12 months in UOB Infinity.

For new UOB Infinity customers, you can only view/retrieve account activity data for the past 2 months when you access UOB Infinity for the first time.

What if I need to view account activity data beyond 12 months?>

Please visit your nearest UOB branch to request for the data. Fees may apply.

You will be able to download/export the account statements of all your UOB accounts that are linked to UOB Infinity. Please note that the layout of the downloaded statement differs from the physical account statement.

To download/export account statements:

- From top menu bar, go to Accounts > Account Activities

- Select the account number and date range required.

- Click the “Export” button at the top right corner of the screen.

There are 4 file types available:

- CSV

- Spreadsheet

- Fixed Length

To initiate a payment instruction in UOB Infinity, from the top menu bar, select Pay and Transfer > select the payment type and follow the on-screen instructions accordingly.

For a step-by-step guide, you can access the user guide by clicking the question mark icon ![]() located at the top left of the screen.

located at the top left of the screen.

Yes, you can restrict users to creating/approving payment to specific payees only by allowing them to access pre-approved payees (PAP) only. The Company Administrator can set the user’s access by selecting “PAP Only” under the user’s account setup.

The Payee List shows the 10 most recent payees from the same user with the most recent listed first. There is no filtering by debit account or transaction type.

"If you submit the Bulk payroll before Cut off time on 29-Oct, the beneficiary will be receiving the fund on the same day. If you submit it after cut off time, you request will be processed on the next working day. Note: fund receiving & crediting subject to policy at beneficiary bank, some bank may receive and credit the fund right away, some may receive and recieve by end of day."

You can find out which authoriser is next to approve the transaction from Approval Status:

- From the top menu bar, select Accounts > Approval Status

- Search for your transaction and click the action menu

- Select “Audit Trail” to view the authoriser name

You can approve a payment instruction from:

- Dashboard – In “My Tasks” widget, the five most recent transactions requiring your approval will be listed; OR

- My Tasks – From the top menu bar, select My Tasks to view the full list of requests requiring your approval

If you need a step-by-step guide, please login to UOB Infinity, click the user icon ![]() at the top menu bar and click “Need Help?”.

at the top menu bar and click “Need Help?”.

To set up or update your approval mandate, or change the authorisers’ authorisation groups, please submit a maintenance form.

Every monetary transaction can only be approved according to the approval mandate in the authorisation profile. In addition, you can also set up the following limit controls:

- Limit

- Signatory Daily Limit

- Transaction Limit*

You can check the transaction status by selecting Accounts > Approval Status from the top menu bar.

Approval Status provides a consolidated view of all transaction statuses in a single location. The transactions are classified by their status for easy reference:

- All (white) - all transactions regardless of status

- Pending (orange) - transactions that have not been submitted/sent to the Bank

- Sent to Bank (blue) - transactions that have been submitted to the Bank but have not been processed

- Rejected (red) – transactions that have been rejected or bulk transactions that have been partially rejected

- Successful (green) – transactions that have been successfully processed by the Bank

In addition, the Company Administrator can also set up email or SMS alerts to notify the transaction makers and/or authorisers when a transaction has been successfully processed or rejected.

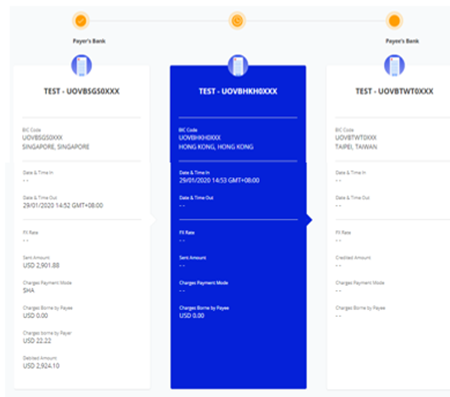

Yes, you can track your cross-border transactions from “Track Payments (SWIFT gpi)”. To access “Track Payments (SWIFT gpi), from the top menu bar, select Pay & Transfer > Track Payments (SWIFT gpi)

This feature allows users to do end-to-end tracking of their incoming/outgoing cross-border payments, which includes Telegraphic Transfers transactions.

SWIFT Global Payment Innovation (SWIFT gpi) is a service offered by SWIFT, aimed at transforming the customer experience in tracking cross-border payments.

Yes, you can track telegraphic transfers submitted over the counter as long as you know the originating account number of the payments.

The blue column indicates where the payment is at currently.

A coloured circle can be found on top of each bank’s column indicating the status of the transaction at each bank:

- Green - Completed

- Orange - In Progress / On Hold

- Red - Rejected

- Grey – Not traceable (e.g. the payment has reached a non-SWIFT bank)

For a more detailed explanation of this feature, please login to UOB Infinity, click the user icon ![]() at the top menu bar, and click “Need Help?”.

at the top menu bar, and click “Need Help?”.

Yes, you can export the transaction details as a PDF or CSV file. The CSV file format is only applicable for bulk transactions. For the PDF file format, you can choose to export the transaction details with or without the audit trail information.

To export transaction details:

- From the top menu bar, select Accounts > Approval Status

- Search for the transaction

- From the action menu (

), select “View Details”

), select “View Details” - Select “Export” at the top right of the transaction details

For single transactions:

- If you export as “PDF”, you will be able to download the file immediately.

- If you export as “PDF with Audit Trail”, you will receive an email notification when the file is ready to be downloaded. To download, from the top menu bar, select Accounts > Download Reports. Select “User Generated” tab > click the download icon for the transaction.

For bulk transactions:

- You will receive an email notification when the file is ready to be downloaded. To download, from the top menu bar, select Accounts > Download Reports. Select “User Generated” tab > click the download icon for the transaction.

Yes, there are a payment advices generated for Telegraphic Transfers. To locate the advice, from top menu bar:

-

Select Accounts > Account Activities

-

Select the account number and date range (when the outgoing/incoming Telegraphic Transfer occurred).

-

To download, click the icon available at the “Advice” column

You can also view and export the inward remittance details using the same steps.

If you are subscribing to other reconciliation/statement reports (e.g. MT940), you can request for the report to be made available in UOB Infinity through your relationship manager or by visiting the nearest UOB branch.

To download the report:

- From the top menu bar, select Accounts > Download Reports

- Click the icon under the “Downloads” column.

Please select “Trade Services” in the registration or maintenance form under “Additional Infinity Services”

- Log in to UOB Infinity

- From the top menu bar, click on the drop-down menu “You are in: Cash Management”

- Select “Trade Services (BIBPlus)”

You will be redirected to BIBPlus for trade services. There is no need to log in again.

The interface upgrade of Trade functions is still a work in progress, and will be introduced at a later stage.

- From the top menu bar, click on the drop-down menu “Trade Services”

- Select “Cash Services”

You will be redirected to UOB Infinity Cash Management. There is no need to log in again.

No. You can view trade transactions by selecting “Trade Services (BIBPlus)”.

No. You can approve trade transactions by selecting “Trade Services (BIBPlus)”.

The biometric feature allows you to access the mobile app quickly and securely by using your mobile device’s fingerprint/face recognition function. With this feature, you do not need to enter your password to log in to the UOB Infinity mobile app.

For a step-by-step guide to setup the fingerprint / face recognition authentication, please log in to UOB Infinity, click the user icon (![]() ) at the top menu bar and click “Need Help?”.

) at the top menu bar and click “Need Help?”.

For security reasons, each user is allowed to enable the fingerprint / face recognition function on one mobile device only. If you are switching to a new mobile device, you need to re-enable your fingerprint / face recognition function on the new device. The fingerprint / face recognition function set up on the existing device will be removed automatically once it has been set up on the new mobile device.

For security reasons, your fingerprint / face recognition setup in the app will be removed when you uninstall the app or clear the app data. You will need to re-enable your fingerprint / face recognition function on your mobile device.

For security reasons, your fingerprint / face recognition function will be disabled after the 5th failed attempt. Please use your password to log in so as to re-enable your fingerprint / face recognition function.

Yes, you can approve all types of transactions using the UOB Infinity mobile app.

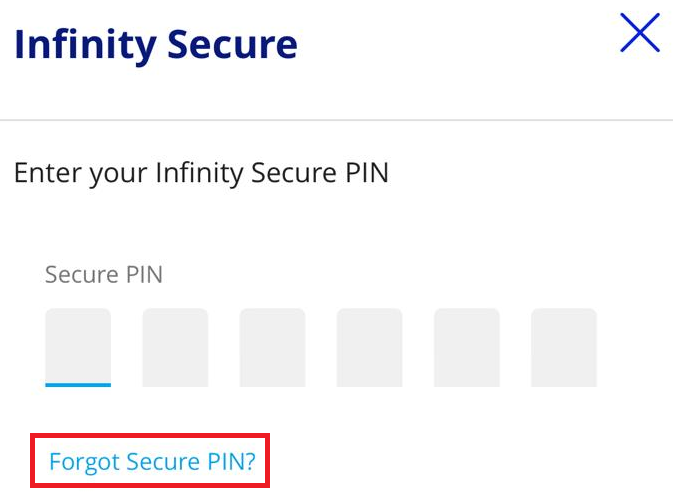

Infinity Secure is a digital security token that allows you to log in to UOB Infinity and approve cash transactions in UOB Infinity.

- Download UOB Infinity mobile app

- Register for Infinity Secure

- Activate Infinity Secure

For a step-by-step guide, please log in to UOB Infinity, click the user icon (![]() ) at the top menu bar and click “Need Help?”.

) at the top menu bar and click “Need Help?”.

If you do not see the option to register Infinity Secure, it is likely that you are using either a private token* or a global token* that is currently not supported by Infinity Secure.

This is a security feature of Infinity Secure’s registration and activation process to prevent fraudulent activation of Infinity Secure.

Infinity Secure will be progressively enhanced to support all functions. In the meantime, the physical token is still required for the following services:

- All trade transactions (e.g. Letter of Credit application)

- All transactions using token sharing (Private Token) service

- All transactions using Global View service

Even if you do not use any of the above three services, please keep your physical token in a secure location as a backup. In the event that you subscribe for any of the above services in the future or should you encounter any unexpected issues when using your Infinity Secure (e.g. loss of mobile phone), you will still be able to authorise transactions using your physical token.

If you require a replacement for your physical token, you need to fill up a maintenance form. Please contact our bank for further assistance.

The benefits are:

- Secure – Infinity Secure is protected by a 6-digit Secure PIN chosen by you. Each UOB Infinity user ID can register for only one Infinity Secure digital token, regardless of the number of mobile devices used.

- Convenient - You do not need to carry the physical token around to log in to UOB Infinity or approve cash transactions. Infinity Secure enables you to receive authentication requests through UOB Infinity’s push notifications.

You may request your Company Administrator (CA) to deregister Infinity Secure that is linked to your user ID. If you are the CA and you have lost your mobile phone, contact the bank immediately.

You can either:

- Deregister Infinity Secure from the UOB Infinity app on your existing mobile device before changing to the new mobile device; OR

- Use your physical token and register Infinity Secure on your new mobile device.

No, Infinity Secure will not be automatically deregistered. You will need to deregister Infinity Secure from your account by following these steps:

- Log in to the UOB Infinity mobile app

- Select “More Services”

- Click “Remove Infinity Secure from this account”

If you have forgotten to deregister Infinity Secure before uninstalling the UOB Infinity mobile app, please use your physical token to log in to the UOB Infinity mobile app and follow the above steps to deregister the Infinity Secure. You can also inform your Company Administrator or call the Bank to deregister your Infinity Secure.

If you have exceeded the maximum number of tries (i.e. 5 times) for your Infinity Secure PIN, for security reasons, you will be required to re-register for Infinity Secure.

Please use your physical token to log in and follow to register and activate your Infinity Secure.

I have forgotten my 6-digit Infinity Secure PIN. What should I do?

For security reasons, there is no reset function for your Infinity Secure PIN. If you have forgotten your 6-digit Infinity Secure PIN, you can select “Forget Secure PIN” on your UOB Infinity mobile screen. After which, you will be guided to re-register for Infinity Secure.

Currently Infinity Secure allows user to login to Infinity within the same location by using the digital token installed on mobile device.

After the enhancement, the user may perform profile linkage to other locations (between Singapore and Malaysia, Viet Nam for the start). The options available for the profile linkage are:

- Infinity Secure only - a digital token which allows user to login to Infinity with multiple user access within or across locations.

- Infinity Secure with Global View – a digital token which allows user to login to Infinity with multiple user access, view consolidated accounts and perform transaction within and across different locations with a single login.

By registering and activating Infinity Secure, you may access, view, and transact all UOB accounts within and across locations with a single login.

You may:

i) Perform self-linkage of user ID.

ii) Get your company administrators to perform linkage.

Yes, you may request for Infinity Secure Linkage on same mobile by following the step listed in Question 5 or 6 below.

Please take note that you have to use single mobile device to install and link 2 users ID profiles using either Singapore, Malaysia or Vietnam Infinity App.

Under Infinity Secure “Manage Infinity Secure’s Linked Profiles” sub-menu, the user can input to-be linked Organisation ID and user ID and choose “Infinity Secure only” option to link users within across locations.

After successful linkage and upgrade of Infinity Secure, initiating user and linked user has to perform Infinity Secure activation. 12 hours cooling off is imposed before user activation process as part of enhanced security measures.

Activation of initiating user

1) Initiating user can activate his own profile after 12 hours cooling off period has passed.

Activation of linked user

1) Activate on behalf of Linked user. To do so, initiating user can select “Manage Infinity Secure’s Linked Profiles” sub-menu, select “Profile” and choose “Activate” option to activate the profile linkage.

2) Alternatively, the Linked user will activate his own Infinity Secure by logging to App directly after 12 hours cooling off period has passed.

Please note that all existing users will be prompted to re-activate their user profile after linkage is completed.

Under Infinity Secure “Manage Infinity Secure’s Linked Profiles” sub-menu, user can input to-be linked Organisation ID and user ID and choose “Infinity Secure with Global View” option to link users within across locations.

After successful linkage and upgrade of Infinity Secure, initiating user and linked user have to perform Infinity Secure activation and there is imposed 12 hours cooling off period during user activation process as part of enhanced security measures. You may refer to user activation process in Question 5.

User has to perform linking with to-be linked new user ID. Upon successful Infinity Secure upgrade, newly linked user has to activate user profile and will be prompted to accept Terms and Conditions if this is 1st time login.

Activation of linked user

1) Activate on behalf of Linked user. To do so, initiating user can select “Manage Infinity Secure’s Linked Profiles” sub-menu, select profile and choose “Activate” option to activate the profile linkage.

Alternatively, the Linked user will activate his own profile after 12 hours cooling off has passed.

Initiating user always has to request for the linkages of the users within or across locations as 1st step.

Initiating user can perform successful linking of user IDs when following conditions are met:

a. Requestor/Initiating User and Linking User to have same Legal ID and

b. Selected Infinity Secure Only Linkage Type (ie without global view feature)

Company administrator of linked user has to approve the linkage when following conditions are met:

a. Requestor and Linked User Legal ID are not matched, or

b. Selected linkage type is Infinity Secure with Global View

Company administrator can only perform tasks on Infinity browser only.

Under Admin menu, there are 2 new sub-menus:

a. “Manage User profile linkage” allow company administrator to authorise or reject Profile Linkage/De-link Request

b. “Profile Linkage enquiry” allow company administrator to view Profile Linkage Request Details and generate Global view linkages reports. User can request profile linkages up till past 12 months, and display 3 months search results at any 1 time. User may also generate profile linkages details in CSV or PDF format.

1. If user (ie authoriser) had selected only “Infinity Secure Linkage only” and linked within same location, Push notification will be sent to the soft token registered device where authoriser can login and authorise transaction.

2. If user (ie authoriser) had selected only “Infinity Secure Linkage only” and linked across different location, authoriser will be redirected to login to Mobile Browser to authorise the transaction. It is still 2 user profiles in different locations using 1 mobile device/Infinity Secure, hence the authoriser is always redirected to Mobile Browser.

3. If user (ie authoriser) had selected only “Infinity Secure with Global View Linkage” and across different location, authoriser can act on push notification and authorize the transaction seamlessly.

User can select “Remove Infinity Secure From This Account” sub-menu from Infinity mobile, and choose the profile to be de-linked.

If selected user is linked user within group, only the linked user will be delinked.

If selected user is primary user, then all the linked users will be delinked.

If the selected user is last user on Infinity App (eg. Singapore’s user ID on Singapore Infinity App), the linked users of other locations (i.e., Vietnam user ID on Singapore Infinity App) will also be delinked.

You must use physical token to access UOB accounts beyond Singapore and Vietnam across all existing locations via Infinity web browser.

Alternatively, you can also easily access Singapore and Vietnam UOB accounts only on Infinity mobile after upgrading to Infinity Secure with Global view functionality.

You can continue to access existing UOB accounts beyond Singapore and Malaysia via Infinity browser using physical token.

You can access Singapore and Malaysia UOB accounts on Infinity Secure currently.

This feature is available on Singapore, Vietnam and Malaysia Mobile App currently and will be rolled out to more locations progressively.

You may perform the following steps:

1. Link Singapore user ID to Vietnamese user ID, you will receive the following SMS:

Dear

2. Next, you may activate your Singapore user ID.

a) A confirmation screen is immediately displayed when the linkage is successful and with instructions on next steps.

b) Confirmation SMS message: Look for below SMS message from the bank confirming the Infinity Secure Linkage. All user sharing Infinity secure will receive the SMS Message.

Linked user in Infinity Secure Profile Linkage request.

"Dear

User Initiated Profile Linkage request and all other users sharing Infinity Secure

"Dear

Confirmation SMS message: Look for below SMS message from the bank confirming the Infinity Secure Linkage. Both Initiating user and linked user of the Infinity secure linkage request will receive the SMS Message.

User initiated Infinity Secure Profile Linkage request. (Approved)

"Dear

Linked user in Infinity Secure Profile Linkage request. (Approved)

"Dear

User initiated Infinity Secure Profile Linkage request. (Rejected)

"Dear

Please contact the respective location UOB Corporate Contact Centre if you require further assistance.

Linked user in Infinity Secure Profile Linkage request. (Rejected)

“Dear

Linked user in Infinity Secure Profile Linkage request. (Rejected)

“Dear

If Infinity Secure Linkage request is rejected, please contact Company Administrator for more information.

1) A confirmation screen is immediately displayed when the linkage is successful and with instructions on next steps.

2) Confirmation SMS message: Look for below SMS message from the bank confirming the Infinity Secure Linkage activation. Both Initiating and linked user of the Infinity Secure Linkage request will receive the SMS Message.

Linked user in Infinity Secure Profile Linkage is being Activated.

“Dear

User Initiated Profile Linkage Activation (Self-Activation)

" Dear

User Initiated Profile Linkage Activation (For Another User)

“Dear

Please contact the respective location UOB Corporate Contact Centre if you require further assistance.

1) A confirmation screen is immediately displayed when the Delink is successful.

2) Confirmation SMS message: Look for below SMS message from the bank confirming the Infinity Secure Linkage. All user sharing Infinity secure will receive the SMS Message.

User Whose Infinity Secure Deregistered

"Dear

User Whose Profile was Delinked / Deregistered from Infinity Secure By Another User

" Dear

Users Who are part of Infinity Secure From where one of the user was delinked / Deregistered.

" Dear

Please contact the respective location UOB Corporate Contact Centre if you require further assistance.

Confirmation SMS message: Look for below SMS message from the bank confirming the Infinity Secure Linkage. All user sharing Infinity secure will receive the SMS Message.

User Whose Infinity Secure Deregistered

"Dear {0}, you have been successfully deregistered from your UOB Infinity Secure by the Company Admin. Call Corporate Contact Centre if you did not make this request."

All other impacted users (approved & not activated, activated)

"Dear {0}, your profile has been successfully deregistered from UOB Infinity Secure by the Company Admin. Call Corporate Contact Centre if you did not make this request."

Users Who are part of Infinity Secure From where one of the user was delinked / Deregistered.

"Dear {0}, a profile has been successfully deregistered from your UOB Infinity Secure by the Company Admin. Call Corporate Contact Centre if you did not make this request."

Please contact the respective location UOB Corporate Contact Centre if you require further assistance.

Confirmation SMS message: Look for below SMS message from the bank confirming the Infinity Secure Linkage.

All Users who are part of Pending Profile Linkage Request.

"Dear

Please contact the respective location UOB Corporate Contact Centre if you require further assistance.

Confirmation SMS message: Look for below SMS message from the bank confirming the Infinity Secure Linkage.

All Users who are part of Pending Profile Linkage Request

"Dear {0}, your profile linkage request has been rejected due to deregistration of your requestor from UOB Infinity Secure by the Company Admin. Call Corporate Contact Centre if you did not make this request."

Please contact the respective location UOB Corporate Contact Centre if you require further assistance.

Confirmation SMS message: Look for below SMS message from the bank confirming the Infinity Secure Linkage.

All Users who are part of Approved Profile Linkage Request.

"Dear {0}, We have detected that your profile has been delinked from UOB Infinity Secure, due to deregistration from your requestor. Call Corporate Contact Centre if you did not make this request."

After downloading Infinity Secure App, user can select “More Services” under Infinity Secure section and start to register or Activate Infinity Secure on the mobile device.

An existing Infinity Secure user will be prompted of existing linkages and will continue with online steps if he wishes to transfer existing linkage to new device.

User transfer linkages can occur from IOS to Android and vice-versa or Singapore Infinity App to Vietnam Infinity App and vice-versa.

New Dual control on Company Administrator would take effect if no Company Administrator or Bank user acted on the pending profile linkage request.

For dual to single control, the 2nd Company Administrator still needs to approve for pending linkage request.

Your latest Legal ID details will be reflected under your user profile.

User will not be able to link or activate a suspended user profile. Deleted user will not be displayed for linking.

Company Administrator will not be able to approve the linkage request if the user profile was suspended or deleted at point of approval.

Company admin has to perform 2 steps as below:

Step 1: Company admin needs to delink the Infinity Secure from the user from “Admin -> Manage User Profile Linkage -> User List -> View Details” before deleting the user.

Confirmation SMS message: Look for below SMS message from the bank confirming the delinking of Infinity Secure. All user sharing Infinity secure will receive the SMS Message.

User Whose Infinity Secure Deregistered.

"Dear {0}, you have been successfully deregistered from your UOB Infinity Secure by the Company Admin. Call Corporate Contact Centre if you did not make this request."

All other impacted users (approved & not activated, activated)

"Dear {0}, your profile has been successfully deregistered from UOB Infinity Secure by the Company Admin. Call Corporate Contact Centre if you did not make this request."

Users Who are part of Infinity Secure From where one of the user was delinked / Deregistered.

"Dear {0}, a profile has been successfully deregistered from your UOB Infinity Secure by the Company Admin. Call Corporate Contact Centre if you did not make this request."

Step 2: Subsequently, Company administrator can delete the user (i.e., maker).

You will still require your physical token to authorise trade transactions. However, you have the flexibility to use Infinity Secure to authorise your cash payments within and across locations, after completing linking process.

UOB Infinity has a system that provides a high standard of security for banking over the Internet. This security system safeguards the confidentiality of your personal account information and banking transactions by employing:

- Multiple levels of firewalls

- 2048-bit Secure Sockets Layer (SSL) encryption – currently recognised internationally to be of the highest standard in encryption technology commercially available

- A two-factor authentication that uses User ID and password (or biometric login for UOB Infinity mobile app) along with a secure token

UOB has also partnered with IBM® to provide our customers with a free download of IBM® Security Trusteer Rapport™ – an online fraud and identity theft protection software to protect you against malware when using UOB Infinity. There will be a popup on UOB Infinity’s login page and you can download the software by clicking “Download Now” button inside the popup.

To further protect your company's account and transaction information while banking via UOB Infinity, we recommend doing the following:

- Change your password regularly as an added security measure

- Clear the browser's cache after each session in UOB Infinity so that details of your transactions are removed

- Always log out properly after you have completed your online banking activities

For more details, you may wish to view our best privacy and security practices.

Update on recommended browsers: from 15-June-2022, Microsoft will be stopping their support for Internet Explorer 11. For an optimal experience, kindly use the following browsers: Google Chrome, Microsoft Edge, Mozilla Firefox and Safari.

You can download our user guides by logging in to UOB Infinity, click the user icon (![]() ) at the top menu bar and click “Need Help?”.

) at the top menu bar and click “Need Help?”.

Should you require any assistance, please call us at the below contact:

- +84 28 3868 9700 (Local & Overseas) for Business banking clients

- 1800 558 880 (Local) / +84 28 3933 1999 (Overseas) for Wholessale banking clients

Yes, we do have regular workshops conducted via webinars. You may register by contacting us at the following phone number:

- +84 28 3868 9700 (Local & Overseas) for Business banking clients

- 1800 558 880 (Local) / +84 28 3933 1999 (Overseas) for Wholessale banking clients