Could you please tell us more about the advantages of raising working capital via bank loans for SMEs?

There are numerous obstacles standing in the way of SMEs when trying to develop their business. They often struggle to make a breakthrough in the market and fail to obtain bank credits or attract human resources due to their small-sized operations. Various studies point out that difficulties in accessing loans is the biggest roadblock for SMEs when it comes to boosting their scale and productivity, acquiring marketshare and forging more job opportunities.

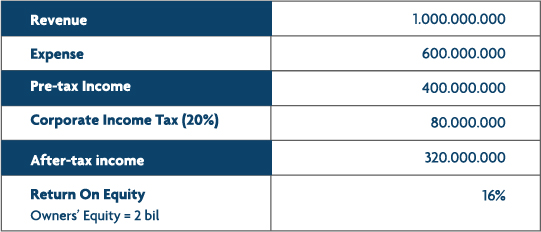

Utilising financial assistance from banks can also reduce the pressure of corporate income tax while increasing the profitability of your business. Let’s take this simple case as an example: Total assets of company are worth VND2 billion, consisting of owners' equity solely. Without any capital loan, here is the company’s income statement:

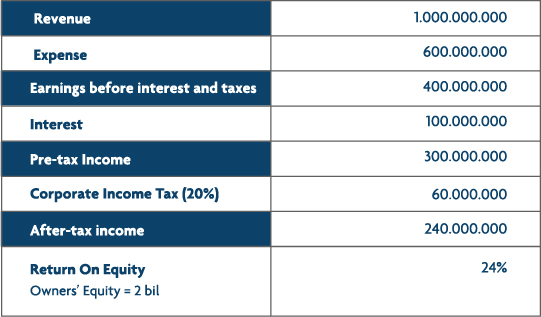

Given that the owner only invests in 50% of owners' equity and applies for a loan at 10% per annum interest rate, the business statement will be adjusted accordingly:

As a result of debt and tax abatement for interest expenses, the amount of corporate income tax is decreased to VND 60 million. It proves that a loan can be beneficial to your business in many ways. Moreover, despite the fact that after-tax income is lower, the return on equity is 24%, which definitely wins over the ratio of 16% when we do not leverage external support.