Digital transformation brings exceptional convenience, enabling seamless fund transfers and real-time asset management from anywhere. However, cyberattacks are growing more sophisticated, increasingly targeting user data. With vast volumes of customer information and financial transactions, the banking and finance industry remains the prime target for these threats. For this reason, customer data security is always our top priority.

What Is Database Security?

Database security encompasses the use of controls, tools, and processes designed to protect databases from both external and internal threats. The main objective is to ensure the confidentiality, integrity, and availability of the data within the database.

Database security assists in protecting data from various threats.

Threats to Database Security in Digital Finance

Digital finance offers significant advantages, but it also harbors increasingly sophisticated cybersecurity risks. In this highly digitized environment, threats to data security are growing in both scale and complexity, requiring organizations and individuals to continuously update their knowledge and adopt advanced data protection methods.

Personal data security has become a top priority, as even a single data breach can shatter customer trust and cause serious damage to revenue and market share. Additionally, businesses must contend with the costs of remediation, compensation, and brand recovery - which can amount to millions of dollars.

Information and data security are key factors in combating cyber threats.

Phishing via Email, Text, and Voice Scams

These situations occur when fraudsters impersonate trusted institutions such as banks, tax authorities, or law enforcement agencies to steal confidential information related to bank accounts, payment cards, or corporate data by sending fraudulent emails, SMS, or making phone calls to deceive you into disclosing card and account details.

How do scams work?

By impersonating a legitimate bank or financial company in Vietnam and creating fake websites or social media accounts, scammers post attractive advertisements - such as low-interest loans, loans for people with bad credit, or loans that do not require collateral or appraisal - to easily lure victims in.

They will ask for personal information such as full name, national ID, and phone number, and instruct you to install a fake app to process the loan application. When the loan cannot be disbursed, scammers offer various excuses (e.g., incorrect beneficiary information or poor network connection) and demand payment to "fix the system". After receiving the money, the scammers cut off all communication.

Additionally, many other common fraudulent schemes exist, such as:

- Online ads inviting you to withdraw cash from a credit card with low or no fees. Scammers then ask for your banking information and OTP to complete an unauthorized transaction.

- Intentionally transferring a small amount of money to a customer’s account, then impersonating the bank to contact the customer. They ask you to click on a malicious link to steal personal information.

- Impersonating a bank’s brand to send warnings about unusual account activity, followed by instructions to access a fake link.

- Contacting customers with attractive offers such as service upgrades, lottery winnings, international fund transfers, or free gifts. In some cases, scammers impersonate police investigators to deceive you and steal your assets.

The Database Security Ecosystem of UOB Vietnam

1. Data Security Standards

Our data security standards are clearly demonstrated through three key aspects:

- We deploy robust encryption solutions, integrated with a modern Intrusion Detection/Prevention System (IDS/IPS) and a Web Application Firewall (WAF). These tools help us promptly detect and block potential threats, ensuring customer data is protected against sophisticated cyberattacks.

- We believe our employees are the most crucial link in our security chain. We prioritize training our staff to enhance their awareness and build a culture of strict adherence to our data security policies. This also involves increasing their vigilance against fraudulent activities to safeguard your data and the bank’s reputation.

- We establish and follow rigorous security control procedures based on the ISO 27001 standard (Information Security Management Systems) and central bank regulations. This ensures that all data-related activities are performed in a secure and transparent manner.

2. Database Security Standards & Technology of UOB Vietnam

We significantly invest in security technology, which serves as the solid foundation for all our products and services. Our two core digital banking apps are equipped with international-standard security solutions to ensure robust protection for users: UOB TMRW Vietnam for personal customers and UOB Infinity for businesses.

2.1 UOB TMRW Vietnam

Your data is kept secure with unusual login alerts and advanced technology from UOB TMRW Vietnam.

The UOB TMRW Vietnam app is designed with leading security features to protect your personal data and financial assets:

- Biometric Authentication (Touch ID, Face ID): Only you can access your app. Your unique biometric data, such as your fingerprint and facial features, are extremely difficult to forge - providing a secure login.

- Unusual Transactional Alerts: For transactions that show signs of irregularity or occur at unfamiliar locations, you will receive a warning notification to help you stay in control.

- Proactively Lock/ Unlock Your Card in the app: In case of emergencies - such as a lost or stolen card, or suspected compromise - you can instantly lock your card with just a few taps in the app. If the card is recovered, reactivation is just as quick and easy in the app.

Experience UOB TMRW Vietnam to feel the international-standard database security!

Explore our UOB TMRW Vietnam to safeguard your assets and your financial future!

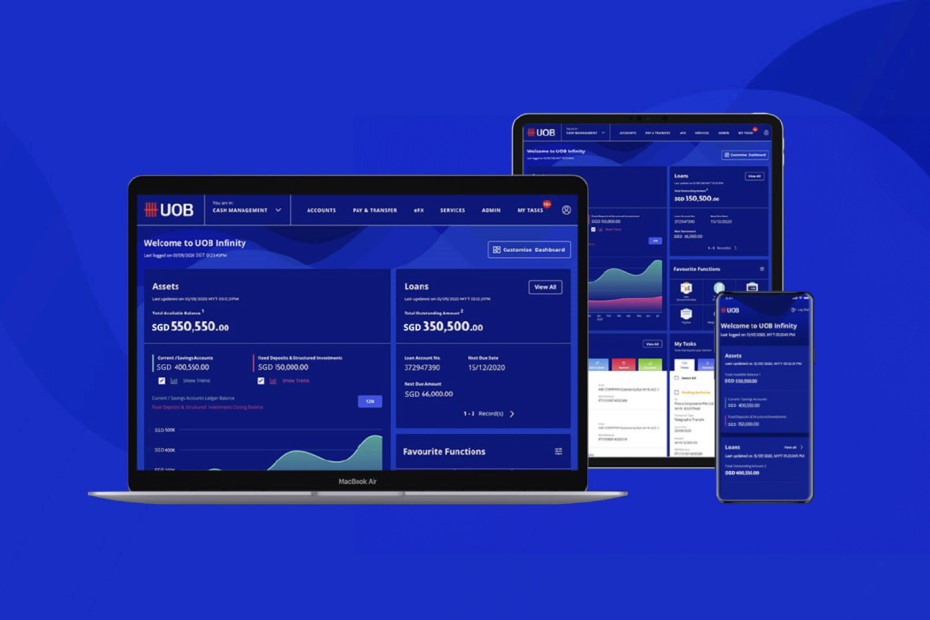

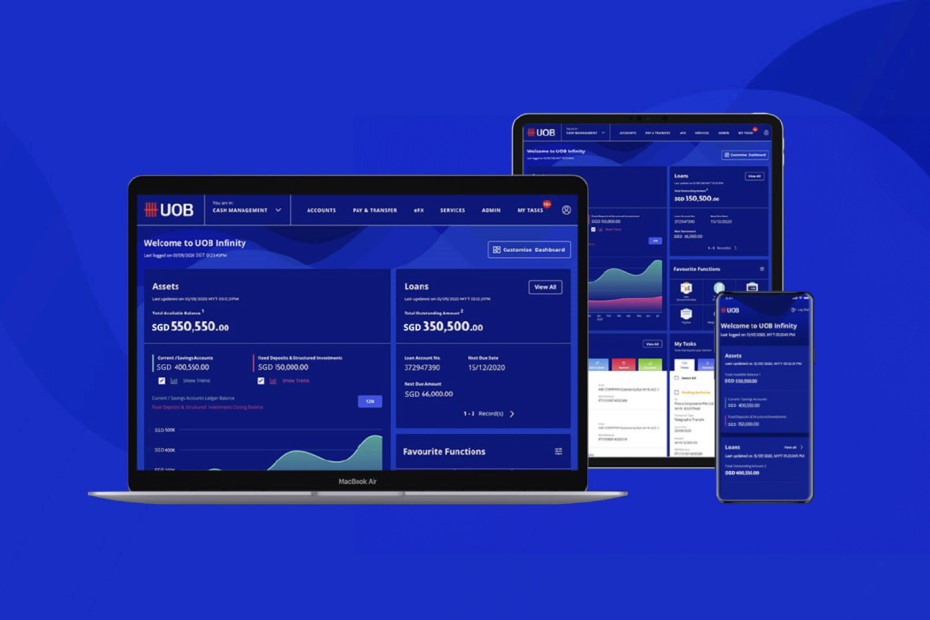

2.2 UOB Infinity

Corporate financial data is kept safe with a security token and multi-level approvals from UOB Infinity.

Addressing the complex needs of businesses, UOB Infinity provides superior operational efficiency and data security.

- Highly secure online portal: Leverage a comprehensive set of security and access control layers that ensure the authenticity of users and safeguard data and transaction confidentiality.

- Comprehensive and customizable dashboard: UOB Infinity allows you to personalize your dashboard display according to your needs, provides a consolidated view of cash positions and direct access to any feature with just one click.

- Direct access to Accounts Overview: A gateway to all your accounts, providing consolidated details of accounts across countries, and allowing you to view account transaction details or make payments with a single click.

- Making payment initiation simple and quick: Make payments with a single click and leverage quick-to-follow guides as you go through the end-to-end payment initiation process.

- Approving and tracking payments efficiently: Approve transactions quickly and online directly from the dashboard, or on-the-go with UOB Infinity.

Moreover, our financial experts provide in-depth advisory services on financial risk management, with database security as an integral part of the process. We assist businesses in comprehensively evaluating potential risks, developing suitable security policies and procedures, and implementing effective preventative and responsive measures.

Explore UOB Infinity - a highly secure and flexible digital banking platform that acts as a financial assistant for your business!

Explore our UOB Infinity to manage your business more effectively and efficiently!

Conclusion

In the current era of booming digital transformation, data has become one of the most important assets for many businesses. At the same time, database security is the core foundation for achieving sustainable growth – for both individuals and businesses. At UOB Vietnam, we believe that only when your data is securely protected can your financial future be secure and prosperous.

This article shall not be copied, distributed or used by any individual or organization for whatever purpose. This article is given for reference only, non-binding and is strictly for information only. The information contained in this article is based on certain assumptions, information and conditions available as at the date of the article and may be subject to change at any time without notice. You should consult your own professional advisers about the issues discussed in this article. Nothing in this article constitutes accounting, legal, regulatory, tax or other advice. This article is not intended as an offer, recommendation, solicitation, or advice to purchase or sell any investment product, securities or instruments.

United Overseas Bank (Vietnam) Limited and its employees have made reasonable efforts to ensure the accuracy and objectivity of the information contained in this article, however, no representation or warranty, whether express or implied, is given as to its accuracy, completeness and objectivity and accept no responsibility or liability for any error, inaccuracy, omission or any consequence or any loss or damage howsoever suffered by any person arising from any reliance on the views expressed and the information in this article.